HÀ NỘI — After years of suffering, the residents could not take the stink any more.

On January 11, they gathered together and set up tents on the road, blocking garbage trucks from carrying waste to the Nam Sơn dumping ground in the capital city’s Sóc Sơn District.

The impact was immediate.

Garbage began piling up on the capital city’s streets over the weekend, and the stink spread rapidly.

Five days later, after reaching a deal with local authorities on compensation for relocation, the people stopped their protest and the road to the Nam Sơn dumping ground was cleared.

But no one was under any illusion that the problem had been solved.

Over the past two years, the capital city has seen several similar protests by residents angry about the polluted environment they have to live in.

Complaints from people in many other provinces who were having to suffer from pollution and attendant problems caused by waste dumps and waste treatment plants have also made headlines.

Not just Hà Nội, the nation as a whole has a serious waste management problem on hand that needs urgent, long-term solutions.

“Clearly, the authorities need to think seriously about the problem of waste management. We can’t waste another minute,” said Đặng Hùng Võ, former deputy minister of environment and natural resources.

“We have so many new technologies, both made in Việt Nam and foreign countries, I don’t know why Việt Nam is still tardy in applying such technologies in this sector that badly needs them,” he said.

No decent burial

Nguyễn Thành Lam, a specialist from the Ministry of Enviroment and Natural Resources, said Việt Nam currently treats its waste mainly with landfills and burning.

Neither of these methods are sustainable.

What has happened in the past years tells us that the landfill is an obsolete solution.

“Waste is not sorted at source in Việt Nam, so organic and plastic waste are buried together. It takes millions of years to decompose plastic. This method also requires large land spaces and cannot be pollution free,” said Đặng Huy Đông, former deputy minister of Planning and Investment.

|

| Landfills and uncontrolled burning of waste are no longer wise choice for Việt Nam.—VNA/VNS Photo Ngọc Hà |

Scientists say landfills are uncontrolled chemistry experiments. In addition to emitting methane (a greenhouse gas 20 times more powerful than carbon dioxide) they require long-term management lasting many decades to ensure that they do not pollute the environment, especially groundwater sources, which has been depleting in Vietnam at an alarming rate.

Sadly, 71 per cent of the country’s waste is buried directly, and the results have not been pretty.

Perhaps the worst of the impacts of pollution caused by waste is the emergence of “cancer villages” where inordinately large numbers or residents suffer from the dreaded disease.

In 2014, a report from the Water Resource Programming and Survey Center under the Ministry of Natural Resources and Environment published a list of 37 cancer villages around the country.

The report said the main reason was water pollution caused by improper and illegal waste dumping and burying, mainly industrial waste.

The lesser evil?

Faced with overflowing landfills and the lack of space for establishing new ones, Việt Nam has in recent years settled on waste burning projects as another cheap alternative.

According to the Ministry of Environment and Natural Resources, there are around 200 incinerators installed nationwide.

Most waste treatment plants say they use waste-to-energy technologies, but scientists counter this, saying that most of the imported technologies can only work when waste is sorted at source, something that does not happen in Việt Nam.

“Burning waste with incinerators can temporarily solve the problem in that people don’t see as much garbage on the streets, but we have to be aware that dioxins and furans are produced during incineration, especially because waste in Việt Nam is not sorted at sources,” said Doãn Hà Thắng, an expert on plasma physics from the Ministry of Science and Technology.

Dioxins, which are highly toxic compounds, are created unintentionally during combustion processes, at either above 200 degrees Celsius, or from 450 to 900 degrees celsisus.

Dioxin decomposition can only happen when the temperature reaches 1200 degrees Celsius, a very expensive proposition that is almost impossible for current incinerators in Việt Nam, Thắng said.

“What does that mean? It means incineration cannot be a short-term or long-term solution. You can’t solve the waste problem by building multi-million dong facilities that will just transform solid waste into another toxic pollution problem. We all know how toxic dioxin is to people’ health,” he said.

To good effect, he added: “It’s a scary scenario.”

“It’s bad enough that we’re facing this waste crisis, but it’s even worse that government officials tasked with protecting our natural resources and safeguarding public health are promoting wrong solutions, particularly, uncontrolled incineration technologies,” he said.

Lam, the specialist from the environment ministry, said the ministry has clearly ordered that waste treatment technologies imported to Việt Nam must not be those outdated and banned by other countries.

“The ministry is encouraging made-in-Vietnam technologies that can specifically solve our own problems and suit our own waste situation,” he said.

Đặng Huy Đông, the former deputy minister of planning and investment agreed with this assessment and suggested that new national standards are formulated for waste treatment, with investors allowed to compete with each other in offering different technological solutions.

“It’s not true that all imported technologies are better than homemade ones. We have many research units working on waste treatment methods. If they’re better, why don’t we take the advantage?” Đông said.

Pyrolysis – will it work?

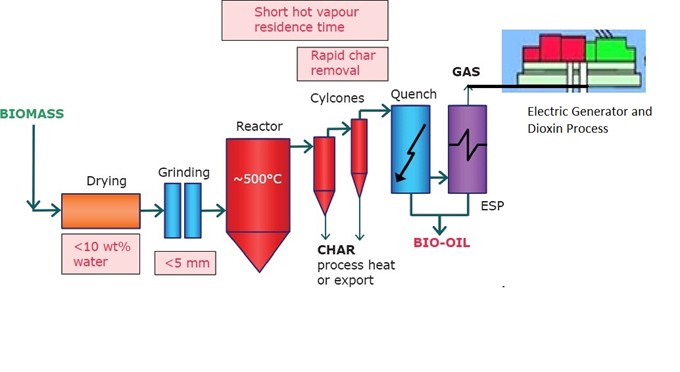

Pyrolysis is a rapidly developing biomass thermal conversion technology that has been garnering much attention worldwide due to its high efficiency and eco-friendly character.

It is said that the technology can convert solid waste, including non-recyclable plastics, into clean energy.

It is a process in which the decomposition of various solid wastes takes place at high temperatures, but in the absence of oxygen.

Thắng, from, the Vietnam space commute office said this method can be applied in Việt Nam, since pyrolysis technology produces less flue gas than direct combustion, especially dioxin and other pollutant.

The small amount of dioxins and furans made during the thermal processes, can be removed when special techniques are applied, Thắng said.

Two of the main trends to remove dioxin and furans in the world are either decomposing dioxins at a temperature of above 1,200 degrees celsius then conduct a rapid cooling phase, or conducting a gas-phase hydrodechlorination of dioxins with the support of pure nanoparticles as a catalyst, following by rapid cooling, he said.

The second method would require a temperature of less than 300 degrees Celsius, which is rather suitable for Việt Nam and other developing countries, he added.

In order for this method to work properly, it is, however, necessary to sort waste, but in a much simpler way.

“We’ll just need to have to divide waste into two types: burnable and unburnable,” Thắng said.

The main products obtained from pyrolysis of municipal waste would be high calorific value gas (synthesis gas or syngas), a biofuel (bio oil or pyrolysis oil) and a solid residue (char).

Syngas can be cleaned to remove particulates, hydrocarbons and soluble matter, and then combusted to generate electricity.

Bio-oil can be upgraded to either engine fuel or syngas through a gasification process and then biodiesel. Pyrolysis oil may also be used as liquid fuel for diesel engines and gas turbines to generate electricity.

The solid residue from municipal solid waste pyrolysis, called char, can be used as a soil supplement.

The cost for a basic pyrolysis module would be a hundreds of time cheaper than the technologies being sold by foreign firms, Thắng said.

He also suggested a change in the Government’s waste management financing options.

“Instead of paying for the waste treatment process, the Government should let private firms take the job and pay for the end products, like energy generated from waste-to-energy plants,” he said.

So far so good, but…

Advanced technologies can help in improving Việt Nam’s waste management, but it is equally, if not more important that the root of the problem is tackled, environmentalists say.

The real solution is to reduce the production of waste through lifestyle changes, they add

This certainly applies to Việt Nam in a big way, as a country that ranks among the top five countries in the world in dumping plastic trash into the ocean.

Last October, Việt Nam last October launched the “Anti-plastic waste” campaign. HCM City has launched a campaign encouraging locals to sort their household waste, and others are said to be considering similar initiatives.

The Hà Nội People’s Committee has developed a new program to fight the overuse of plastic bags and increase eco-friendly practices in industrial complexes.

But given the scale and urgency of the problem, the bigger question remains: is the country acting soon enough or going far enough?—VNS