Houston — Malaysia’s Petronas will buy LNG from Cheniere Energy under a 20-year agreement that will support building a sixth liquefaction train at the exporter’s Sabine Pass terminal in Louisiana.

The long-term offtake deal for approximately 1.1 million mt/year of LNG will be shipped on a free-on-board basis beginning following the date of first commercial delivery from Train 6. Cheniere CEO Jack Fusco told S&P Global Platts in October that the company hoped to make a final investment decision on the train by early next year.

In a statement announcing the sale and purchase agreement with a unit of Petronas, Cheniere said the deal is expected to support the continued progress toward an FID in 2019. The purchase price for the LNG will be indexed to the monthly Henry Hub price, plus a fee.

“We think SPL6 is money-good, and the real questions are really at what price/contract structure and when,” Wells Fargo Securities analyst Michael Webber said in a note to clients after the announcement. “With execution of the EPC contract with Bechtel (November), the one milestone they now need to sort out over the next 3-4 months is financing.”

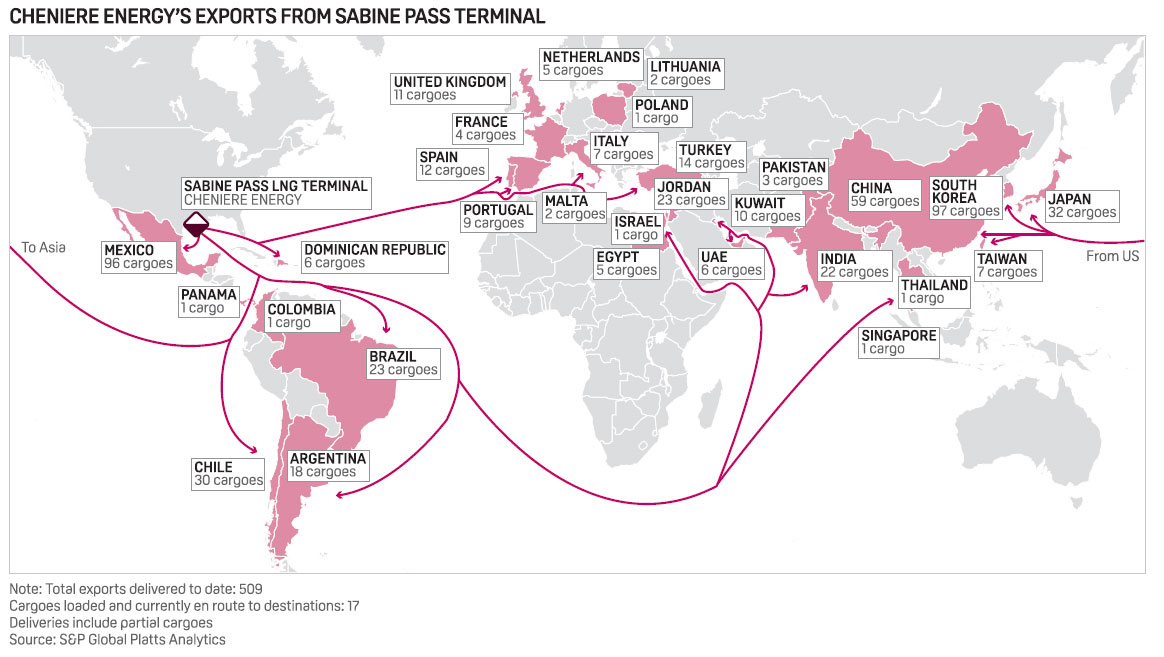

Despite market uncertainty and continuing US trade tensions with China, Cheniere has projected a confident market outlook in recent months, and on both the financial and commercial fronts it has managed to outmaneuver many of its US peers, thanks in part to being first to market among major US LNG exporters when Sabine Pass started up in 2016. Also, its one-stop shop for producing, marketing and delivering LNG around the world on a destination-flexible basis gives it a competitive advantage.

Cheniere has been stressing to the Trump administration the importance of US LNG in the global marketplace and encouraging it to ease tensions with Beijing. China imposed tariffs on imports of US LNG starting September 24, and with less than two weeks before the end of 2018 there is no sign of the duties being lifted anytime soon.

Click here to view larger image

Cheniere is currently operating five trains at Sabine Pass and one train at its export terminal near Corpus Christi, Texas. The facility in Texas recently shipped its first cargo, which is on its way to Greece. Two more trains are under construction at Corpus Christi.

While the agreement with Petronas is the first one announced by Cheniere that is directly tied to the proposed Train 6 at Sabine Pass, in general, other SPAs with investment grade counterparties can be used to support financing for new LNG capacity. Cheniere has reached several such deals this year, though early ones will support the third train at Corpus Christi.

“We think Cheniere had been looking to get one or more FOB contracts signed to help simplify the financing process (it’s simply easier to underwrite fixed-price FOB contracts and keep DES business at CMI) — with 1.8 mtpa (~38%) FOB commitments and the inclusion of one DES contract (1.45 mtpa PGNiG or 2 mtpa CPC) able to get them to ~70-81% (which should be more than sufficient coverage to take to its lenders),” Webber said.

The analyst added, “Given significant commercial progress and Cheniere’s investment grade rating, we don’t expect any major issues with financing.”