While electric vehicles (EVs) are expected to be cheaper than internal combustion engine (ICE) or conventional vehicles in Europe in just three years from now, green vehicles are still far too costly for most drivers in Southeast Asia. A lack of subsidies and infrastructure is holding back EV adoption in the region, experts say.

Bloomberg New Energy Finance (BNEF) forecast in April that the “crossover point” between ICE and EV prices will arrive in the EU in 2022. The main reason is that prices of EV batteries, which make up half the car’s total cost, are coming down every year. The crossover point — when EVs become cheaper than ICE cars — won’t be seen in Asean in the foreseeable future, although some hopeful signs are emerging.

“EV prices in Southeast Asia are more expensive than in other developed markets like the US, Europe, Australia and China,” Justin Wu, head of Asia Pacific for BNEF, told reporters in Bangkok last month.

The main culprits in the eyes of the general public are taxes, while experts point to the lack of subsidies and infrastructure such as charging stations. Taxes and subsidies depend entirely on government decisions, while infrastructure can be built either by governments or via public-private partnerships.

Policymakers throughout the region are now exploring many options. But few have been announced or introduced on a wide scale, even though action could have been taken five years ago when EV battery costs started to visibly decline.

As recently as 2016, prospective EV buyers in Thailand found their choices limited to plug-in hybrid electric vehicles (PHEV) priced at over 2 million baht (US$65,000). Now there are more than 10 models from Audi, BYD, FOMM, Hyundai, Jaguar, Kia and Nissan, although all but the FOMM carry seven-figure price tags. MG, the newest entry in the field, introduced its ZS EV in Bangkok two weeks ago for 1.19 million baht ($38,730).

“My previous prediction might be wrong. Prices for EV cars might come down to less than 1 million baht as soon as 2020,” Yossapong Laoonual, president of the Electric Vehicle Association of Thailand (EVAT), told Asia Focus, reiterating his contention that the more the competition, the lower the price.

GLOBAL TREND

There are now more than 5 million EVs on the roads worldwide, of which 2 million were sold in 2018 alone, compared to just a few thousand in 2010. “There is no sign of a slowdown,” Colin McKerracher, head of Advanced Transport at BNEF, wrote in its latest report on EVs.

“We expect annual passenger EV sales to rise to 10 million in 2025, 28 million in 2030 and 56 million by 2040,” he said.

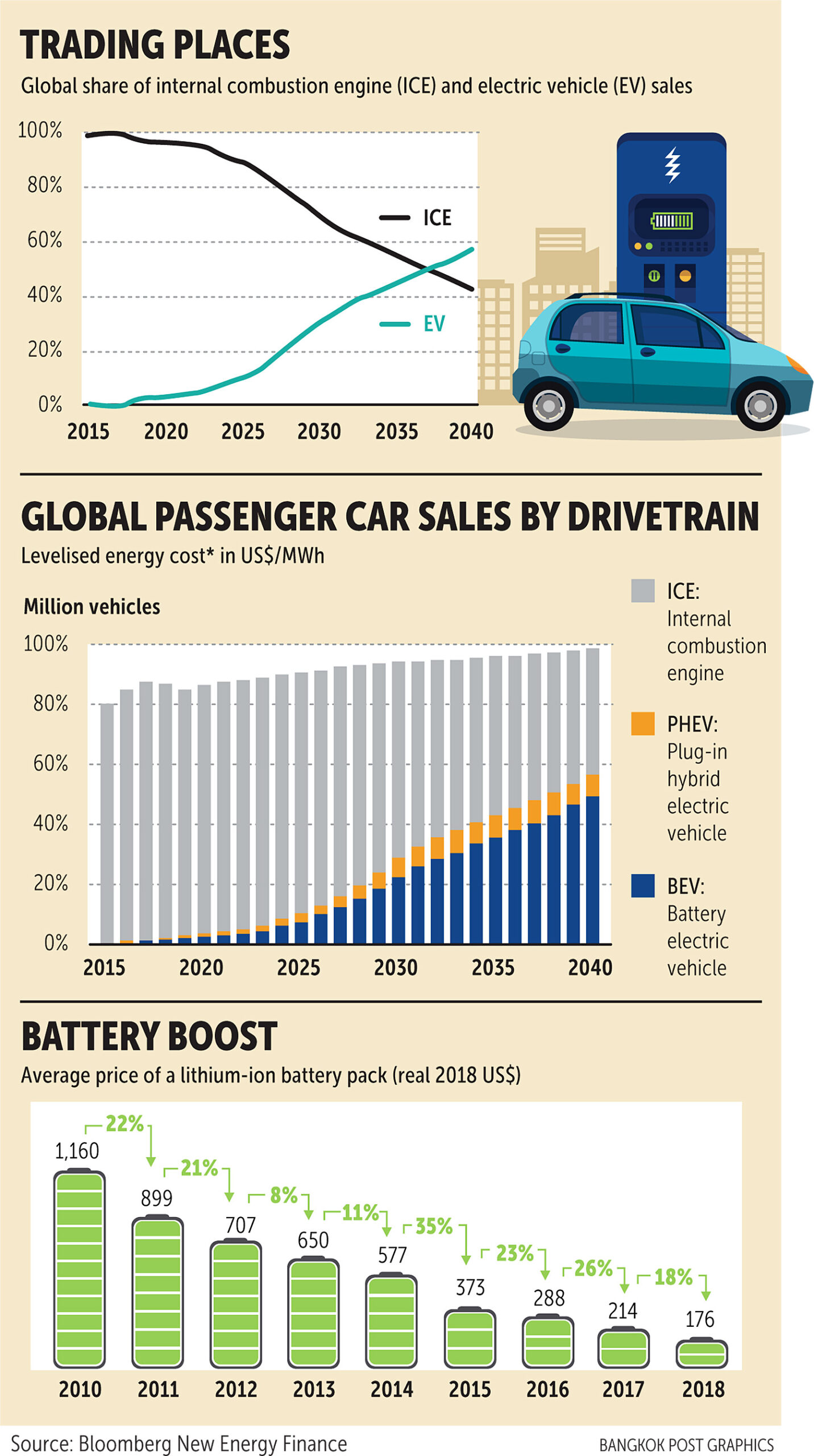

BNEF also expects conventional passenger vehicle sales to fall to 42 million by 2040, from around 85 million in 2018, as policy support such as fuel economy regulations and China’s new energy vehicle mandate will drive the EV market in the next five to seven years, before pure economics takes over in the latter half of the 2020s.

Mr McKerracher pointed out that battery prices have kept falling every year, from $1,160 in 2010 to $176 last year. At the same time, emission regulations are getting tougher at both the city and national levels globally, while automakers are responding with new EV models that are expected to hit the market more frequently in the next five years.

Energy Absolute Plc is aiming to have 5,000 of its Mine Mobility EVs on the roads in Thailand by next year. It said it received more than 4,500 orders in April at the Bangkok International Motor Show, at 1.2 million baht each. (Photo: Patipat Janthong)

Energy Absolute Plc is aiming to have 5,000 of its Mine Mobility EVs on the roads in Thailand by next year. It said it received more than 4,500 orders in April at the Bangkok International Motor Show, at 1.2 million baht each. (Photo: Patipat Janthong)

“As a result, we expect price parity between EVs and internal combustion vehicles by the mid-2020s in most segments, though there is wide variation between geographies and vehicle segments,” he added. With that in mind, BNEF projects EVs are on track to take up 57% of global passenger car sales by 2040.

But even with EVs’ share of new sales rising and battery prices falling, EVs still account for less than 0.5% of the global vehicle fleet of over one billion vehicles. Most of them are in China, Europe, North America, Japan and South Korea.

At present, China is the world’s biggest market for EVs in all segments, and represents 76% of all commissioned lithium-ion battery manufacturing capacity. The country accounted for 60% of global EV sales in the fourth quarter of 2018 and half of global public vehicle-charging infrastructure. By the end of last year, EVs made up 7% of new vehicle sales in China, with a compound growth rate of 118% since 2011.

BNEF now expects annual EV sales in China to reach 2 million units in 2020 after hitting one million for the first time last year. Government support such as the direct EV purchase subsidies is one big reason.

In Thailand, cumulative registrations of all EVs with the Department of Land Transport stood at 1,800 units in 2017, mainly electric motorbikes, compared with more than 5 million EVs on the road globally, according to BNEF. An EVAT report tallied just 100 battery electric cars on Thai roads as of February 2018 compared with around 400,000 passenger cars sold in the country last year.

“This means that the number of battery electric cars has doubled from 2017 to 2018 even though it is still a small number,” Mr Yossapong said on the sidelines of the International Electric Vehicle Technology Conference and Exhibition and Asean EV Summit 2019 in June.

Chatri Limpongsai, executive director of the Board of Investment, said the current incentives offered to charging station operators should lead to more than 7,000 stations in the “coming years”. He also acknowledged that several companies are planning to invest in hybrid electric, PHEV and battery electric vehicle (BEV) production facilities, as well as EV stations, and had submitted applications for incentives. The total value of applications in all three segments is $4.7 billion.

Moreover, growing air pollution in major cities throughout the region means that many governments in Asean are aiming to increase the number of EVs via policy measures and infrastructure construction, while the EVAT and related associations are working together to support this development.

ASEAN VISIONS

According to an Asean Secretariat report on its fuel economy roadmap for transport between 2018 and 2025, strong EV sales in the US, Europe, Japan and China are mainly driven by policy support and a minimum subsidy of $3,000 per vehicle.

Currently, a buyer in China of a pure battery EV with a driving range of 400 kilometres and above is eligible for a subsidy of 50,000 yuan ($7,260). However, that figure will be halved next year. Authorities are scaling back subsidies to encourage local manufacturers to rely on innovation rather than government assistance as the industry matures and costs fall.

Starting in 2020, EVs in China need to have a range of at least 250km per charge, compared with 150km previously, to qualify for any subsidy. The country also plans to cut subsidies before phasing them out completely after 2020.

So far, no Asean country is offering direct EV purchase subsidies, but there are other incentives, especially for two-wheel and three-wheel EVs along with EVs for public transport. This is in line with BNEF recommendations that emerging markets should start with those types of vehicles. Motorcycle sales in Asean totalled about 12 million units last year, led by Indonesia, Vietnam, Thailand, the Philippines and Malaysia.

MG, the newest entry in the local plug-in field, introduced its ZS EV in Bangkok in April for 1.19 million baht. (Photo: Patipat Janthong)

MG, the newest entry in the local plug-in field, introduced its ZS EV in Bangkok in April for 1.19 million baht. (Photo: Patipat Janthong)

“Once each Asean country can adopt EVs for public transport and spread charging stations across the country, the cost of EVs will drop with the start of local manufacturing,” said Mr Wu.

Dennis Chuah, president of the Electric Vehicle Association of Malaysia, told the Asean EV Summit that his country was now aiming to have 2,000 electric buses and 135,000 charging stations by 2020 but it has yet to achieve “even 30%” of that goal.

Under Malaysia’s Energy Efficient Vehicles policy, which includes electric and hybrid vehicles, once the targets mentioned are achieved, an excise duty exemption will be allowed. The country now has 234 EV battery charging stations run by a government agency.

A Malaysian company has been developing electric buses locally and the government has provided funding to build a route and highway only for electric buses in Kuala Lumpur.

“This route is almost 100 kilometres which is dedicated only for electric buses,” Mr Chuah said of the world’s first all-electric bus rapid transit system that was launched in 2015. The BRT-Sunway Line runs on an elevated route through the city with 15 electric buses supplied by BYD of China.

The Malaysian carmaker Proton, in which Geely of China now holds a 49.9% stake, is now producing hybrids and all-EVs locally. Honda, BMW and Mercedes are also assembling hybrid cars in Malaysia due to a tax exemption.

Edmund Araga, president of the Electric Vehicle Association of the Philippines (EVAP), said his government and the association set a target a decade ago to have more than 1 million EVs by 2020 but “apparently, we haven’t reached that target yet”.

“However, under the current administration, we are seeing a bright future ahead on modernising public transport,” he said.

According to the EVAP, around 9,000 units of EVs, most of them two- or three-wheelers, were on local roads at the end of 2017 compared with 10.4 million ICE vehicles. There are also more than 1,400 e-jeepneys and e-trikes in service in the Philippines in 19 locations, according to the Board of Investments. The EVAP expects to have 200 stations in place by 2022.

EMISSION INCENTIVES

Singapore, meanwhile, last year revamped its carbon emission-based vehicle scheme to a broad-based emissions scheme, which allowed most BEVs to qualify for a maximum rebate of S$20,000 (US$14,775).

Terence Siew, president of the Electric Vehicle Association of Singapore, said the policy change currently covers only plug-in hybrid and all-electric vehicles, but his association sees it as “a good tool” by the government to reduce vehicle emissions.

Singapore is also home to an EV ride-sharing company called BlueSG. Founded in 2017 with a goal of 1,000 shared EV cars by 2020, it is on track to do so with more than 400 blue cars already deployed. BlueSG also aims to have 2,000 charging stations by 2020 to support shared EV cars. The government-owned electricity and gas distribution firm Singapore Power also plans to build more than 1,000 stations by next year.

“This is a good development for private EV owners who can also use the charging stations for their cars,” Mr Siew said.

According to the Land Transport Authority, 93% of the total 610,000 registered private cars in Singapore as of 2018 were ICEs. Of the total, only 4.3% were mild hybrids (combining a fuel engine with an electric motor), 0.06% (357) were plug-in hybrids and 0.08% (466) were pure electric.

In Thailand, the ambitious S-curve policy to promote new industries aims to put 1.2 million EVs on local roads by 2036, compared with just 1,500 battery-powered vehicles today. The BoI says the number of projects it has approved should result in more than 7,000 charging stations in a few years, from about 500 at the end of 2018.

The numbers show there is still a long way to go for EVs in Asean, but the good news in Thailand is that one local company, Energy Absolute, is now using subsidies and tax breaks to put 5,000 EVs on the road by next year, backed by 700-plus charging stations. It’s also planning a $3-billion factory to make lithium-ion batteries.

The country’s second-largest electricity generating company by market capitalisation, EA introduced its Mine Mobility passenger EV at this year’s Bangkok Motor Show and immediately received more than 4,500 orders. The car is priced at about 1.2 million baht ($38,000).

Thailand is the first country in Southeast Asia to offer incentives for EV manufacturers and tax reductions on sales of their cars. Companies can get corporate tax breaks for eight years, exemptions from import duties on machinery and parts, and reductions in excise taxes. That combination of policies and incentives is the most advanced in the region, according to BNEF.

With Indonesia announcing that it would scrap taxes on imports of EVs and hybrid vehicles by June 30, the outlook is brightening for prospective EV buyers in Asean, and for a better environment for all of us.