Singapore — Thailand’s Map Ta Phut phase 3 expansion has turned focus to Southeast Asia’s demand growth potential and future balancing role in global LNG, as oversupply concerns extend into the mid-2020s.

Thailand’s Gulf PTT Tank Consortium signed a 30-year contract with the Industrial Estate Authority of Thailand (IEAT) on Tuesday for the third phase of the Map Ta Phut LNG terminal, which would add 5 million mt/year of import capacity from 2025 before ramping up to 10.8 million mt/year.

Map Ta Phut, Thailand’s only LNG terminal, has a current capacity of 10 million mt/year and received 4.4 million mt in 2018, with S&P Global Platts Analytics forecasting the country’s consumption to rise to nearly 10 million mt/year by 2022.

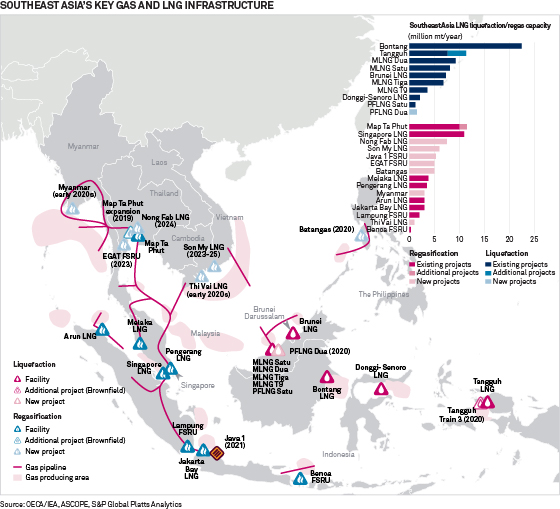

Thailand is the biggest LNG consumer in Southeast Asia, followed by Singapore, Indonesia and Malaysia, while emerging buyers like Vietnam and the Philippines are also set to enter the market in the coming years as they seek reliable sources of energy to fuel their growing economies.

The growth potential of Southeast Asia, the world’s third most populous region and fastest growing LNG demand center, is so significant that the end of the forecast period of structural oversupply in the global market is likely, in part, to be determined by how quickly these new demand centers absorb the excess volume.

The region’s demand is set to more than double from 12.1 million mt in 2018 to more than 25 million mt/year by 2025, driven by upstream output declines, limited pipeline connectivity and growing consumption from the power and industrial sectors.

“Map Ta Phut’s expansion is a promising development in a market where the supply side of the equation is becoming increasingly more transparent while we are waiting for demand to show up on the other side,” said S&P Global Platts Analytics‘ Jeff Moore.

Click here for full-size image

NEXT: OFFTAKE AGREEMENTS

What is lagging behind are the subsequent long-term offtake agreements with suppliers, with more than 75% of liquefaction capacity that is expected to come online by 2025 not contracted to downstream demand sources.

“The next step will likely be for buyers who represent downstream demand to start to sign up for new offtake agreements,” Moore added.

Construction of the project is expected to be completed within three years, with operation scheduled to start in 2025 and total costs estimated at Baht 40.9 million ($1.3 billion).

The project is part of a larger Southeast Asian push for LNG infrastructure developments, on the back of booming gas demand in the region.

Australian company LNG Limited recently reached an agreement for its proposed Magnolia LNG export terminal in Louisiana to supply 2 million mt/year of LNG to support a gas-to-power project in Vietnam under a 20-year sale and purchase agreement.

Upcoming infrastructure projects in Southeast Asia will be key to help mop up the structural supply glut which has put Asian LNG prices under pressure.

Platts JKM, the daily benchmark price for spot deliveries to Northeast Asia, averaged $5.40/MMBtu over January-August 2019, down from $9.46/MMBtu over the same period in 2018.

Gulf Energy Development Public Company Limited and PTT Tank Terminal Company Limited own 70% and 30% of the shares in the Gulf PTT Tank consortium, respectively.