[vc_row css=”.vc_custom_1565542682041{margin-right: 0px !important;margin-left: 0px !important;}”][vc_column css=”.vc_custom_1565542696462{padding-right: 0px !important;padding-left: 0px !important;}”][vc_single_image image=”7037″ img_size=”full”][/vc_column][/vc_row][vc_row css=”.vc_custom_1565542751414{margin-right: 0px !important;margin-left: 0px !important;}”][vc_column width=”1/4″][/vc_column][vc_column width=”1/2″][vc_column_text el_class=”title-event”][post_title][/vc_column_text][vc_column_text el_class=”author-pers”]By Justin Sitohang and Zulfikar Yurnaidi[/vc_column_text][vc_column_text el_class=”date-venue-news”][post_date][/vc_column_text][vc_column_text el_class=”text-par-news”]Roles of Battery in Sustainable Development

Ever-growing concerns of greenhouse gas emissions (GHG) and incremental energy needs drive people to seek alternative energy solutions across sectors. Renewable energy (RE) is considered as a primary breakthrough in the electricity sector. To maximise its full capabilities, grid-scale battery storage systems plays a prominent role to integrate all shares of variable RE by both balancing the supply intermittency and addressing demand variability.

Moving to transportation, electrical vehicle (EV) is expected to push global automotive sales over the coming years due to declining battery prices, wider product range, expanded infrastructure, and supportive policy measures. According to Frost & Sullivan’s Global Electric Vehicle Market Outlook, global EV sales in 2019 of 2.8 million are having Asia Pacific market for 60.3%, followed by Europe with 22.0%. Moreover, over 2.5 million electric vehicles are likely to be sold by 2020 with China continues to be the leader with a 53% market share.

These energy transition waves demonstrate that battery holds vital roles for future low-carbon technologies. In addition, the rapid innovation of information and communication technology has also amplified the use rate of the batteries. Nowadays, Lithium-Ion Battery (LIB) has been considered as the frontrunner among all types of battery owing to its feature on energy density, lifetime, safety, and cost.

Hidden Threats of LIB

New types of LIB have been extensively explored in recent years. By having slight structural modifications on its cathode materials, there are lithium manganese oxide (LMO), lithium iron phosphate (LFP), lithium nickel manganese cobalt oxide (NMC), and lithium nickel cobalt aluminium (NCA) for electric automobiles; lithium cobalt oxide (LCO) and LFD for electronics and small rechargeable batteries; and lithium titanate (LTO) for electric power train and grid storage.

However, LIB’s materials which are mined from 37 different countries including Southeast Asia region would emit environmental pollutants and GHG during different points of its lifetime, i.e. mining, manufacturing, use, transportation, storage, and disposal. Making it worse, these materials are also classified as rare materials which would pose serious sustainability concern for the future exponential growth of LIB’s demand. For instance, Karlsruhe Institute of Technology (KIT) expected that high future demand for battery and complicated geopolitics might result in a shortage supply and price increase of cobalt over the next 30 years.

Addressing these threats, recycling spent LIBs could be considered as the ultimate solution to prolong the End-of-Life (EOL) of lithium-ion batteries. This solution allows us to return valuable materials back into the value chain and close the loop of LIB life-cycle, realising circular economy.

The State-of-the-Art of LIB Recycling

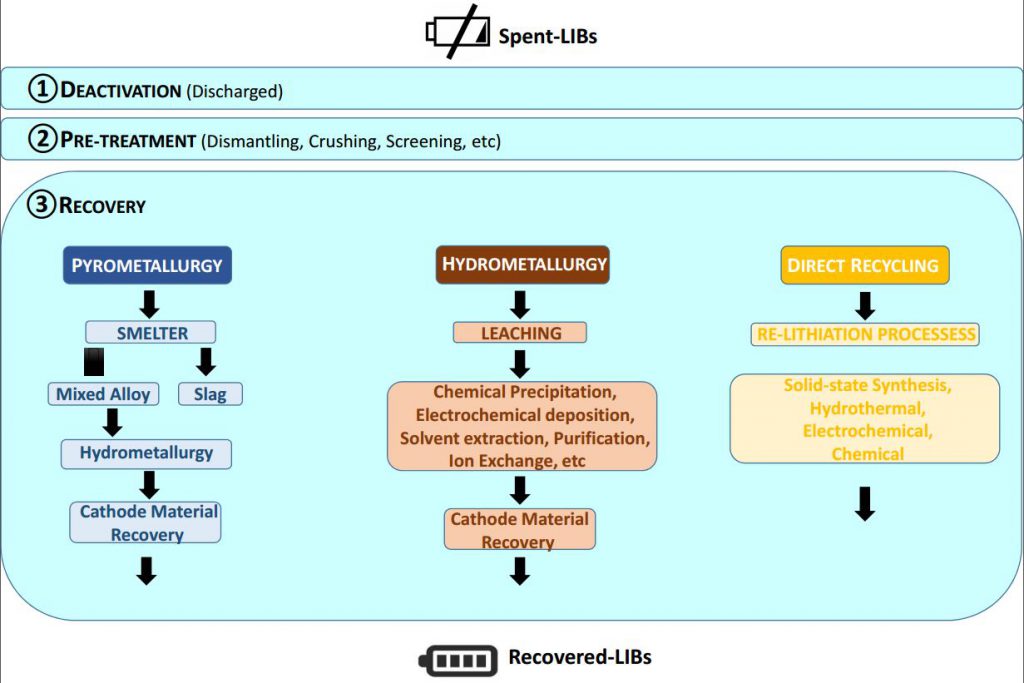

Figure 1. The potential recycling process of lithium-ion batteries (LIBs)

Figure 1 points out that the recycling process of spent LIB mainly includes deactivation, pre-treatment, and recovery. These entire processes aim to reduce the scrap volume, separate battery components, enrich valuable metals, and eliminate hazardous waste released to the environment. Prior to processing, the used LIB should be first discharged to reduce the existence of lithium metal and minimise the risk of explosion. Afterward, to improve the efficiency of materials recycling, either a mechanical or chemical pre-treatment process is required to separate the different waste battery streams. The pre-treatment process mainly includes dismantling, crushing, screening, thermal treatment, etc.

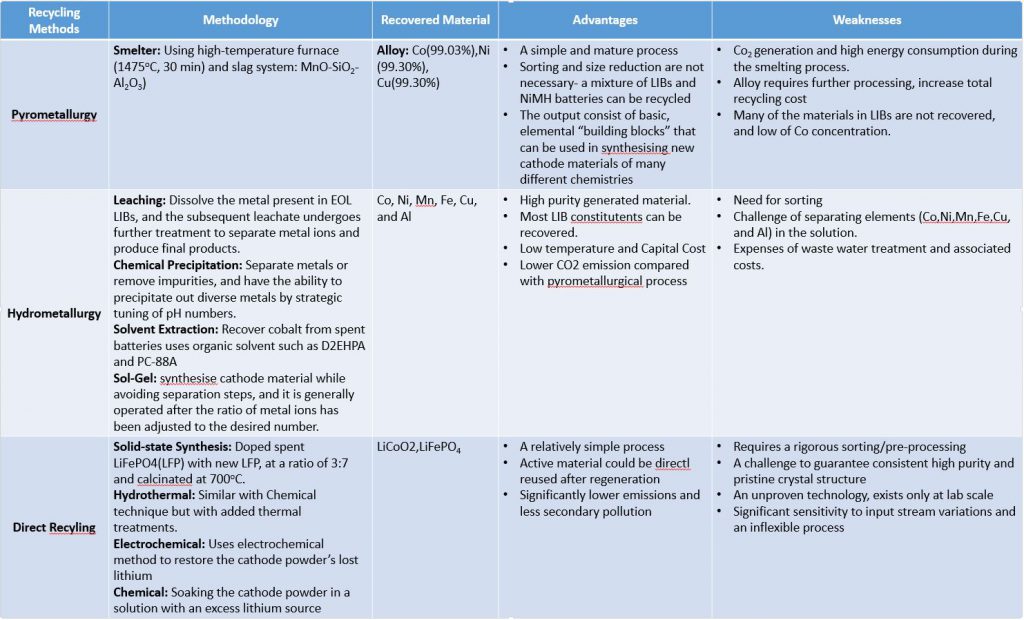

Thereafter, to separate impurities or recover the valuable metals from a specific waste stream, Table 1 shows a brief description of three basic metallurgical process techniques to be applied: pyrometallurgy, hydrometallurgy, and direct recycling.

Table 1: Comparison of three basic metallurgical techniques for spent LIBs recovery

These techniques have been applying worldwide with most of the facilities being concentrated in China, the US, and Europe. However, LIBs threats would inevitably spread into the ASEAN region as well. This is a direct consequence of ASEAN setting ambitious targets to augment its RE share and transform its transportation to EV over the coming years. As the quantity of LIBs becomes significant, LIBs recycling facilities are absolutely needed to tackle the upcoming threats.

Technology Demonstration of LIB Recycling

According to Frost and Sullivan Outlook, the global EV battery recycling market generated a revenue of $10.3 million in 2018 and would reach $6,524.2 million by 2025, expanding at a CAGR of 151.5%. Seeing the revenue distribution, the hydro-metallurgical process contributes 59%, followed by the pyro-metallurgical process at 39% and other recycling technologies at 2%.

By region, LIB recycling regulations have been implemented in Europe, China, and America where both pyrometallurgy and hydrometallurgy are primarily deployed. The European Union has stringent laws regarding LIB recycling: efficiency should reach 50% by 2030. Meanwhile, China stamps specific ID to EVs which will help track the batteries up to recycling. In the US, California set a new goal to develop new market opportunities for battery recycling and will continue to be the national leader in LIB recycling.

As EV and RE start gaining popularity in ASEAN, the countries that aim to become a global hub of EV production has considered starting investment in its environmental aspect.

Indonesia as the biggest nickel reserves in the world is moving to the next stage of nickel processing with the end goal of producing its own lithium batteries. Government partners with Chinese battery company GEM Co LTD and lithium battery maker, Contemporary Amperex Technology (CATL), to build High-Pressure Acid Leaching (HPAL) plants which would start commissioning in Morowali by August 2020, though the project is still waiting for environmental licenses from Ministry of Environment and Forestry.

Meanwhile, in Singapore, TES company announced the opening of battery recycling facility by November 2019. This facility applies an innovative recycling process utilising in-house technology and equipment. With this facility, TES aligns with Singapore’s vision to build a country that is sustainable, resource-efficient, and climate-resilient by enabling Singapore to close the resource loop for lithium batteries and supporting Singapore’s upcoming Extended Producer Responsibility system to manage e-waste.

Furthermore, Toyota Motor has realised their ambition to bring all used hybrid electric vehicle batteries to undergo proper battery life cycle management plant in Chachoengsao Province, Thailand. The plant manages all spent batteries from multiple brands and electric devices by applying a 3R scheme (rebuild, reuse, and recycle). Such a scheme will significantly reduce the cost of hybrid batteries, mitigate negative environmental impact, and establish a solid foundation for the future growth of EV.

Once spent LIBs reach a certain volume, effective battery recycling management as the mainstay of the future energy transition is absolutely needed to address sustainability concerns. Even though ASEAN region has initiated bold moves to anticipate this future disruption, but in order to further develop market opportunities, ASEAN should focus more on these following areas: the advancement of recycling technologies, creating a viable business model for LIB’s recycling, supporting government policies to boost key player awareness, and designing distributed recycling facilities across the region for optimising logistic gains.

Source:

1) Chen, M., Chen, B., Ma, X., 2019. Recycling End-of-Life Electric Vehicle Lithium-Ion Batteries, https://doi.org/10.1016/j.joule.2019.09.014

2) Huang, B., Pan, Z., Su, X., An., 2018. Recyling of lithium-ion batteries: Recent advances and perspectives, https://doi.org/10.1016/j.jpowsour.2018.07.116[/vc_column_text][/vc_column][vc_column width=”1/4″][/vc_column][/vc_row]