- Others

–

- Vietnam

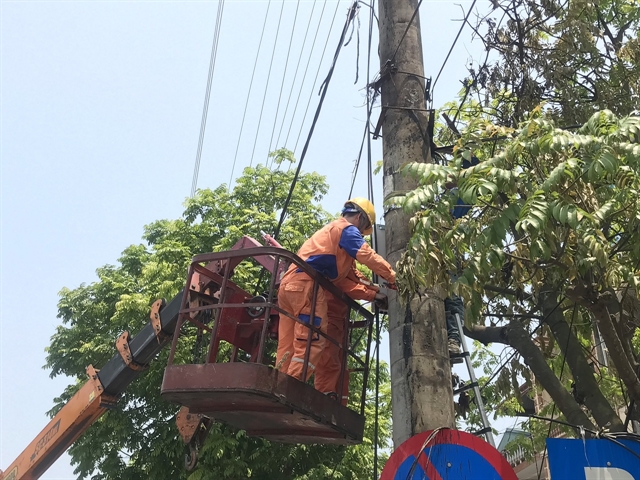

EVN engineers repair power lines. EVN ensured all procedures in calculating power bills to customers after the rise. — Photo courtesy of EVN

HÀ NỘI — Electricity retail prices should have been raised by 9.26 per cent instead of 8.36 per cent if Việt Nam Electricity (EVN) had correctly calculated the VNĐ3.26 trillion foreign exchange rate difference in 2018 into its power production costs.

The information was released by the Ministry of Industry and Trade (MoIT) in a report to Prime Minister Nguyễn Xuân Phúc.

Electricity tariffs were raised by 8.36 per cent to VNĐ1,864 (8.03 US cents) on March 20. However, many households have complained about sudden increases in their electricity bills, which doubled or tripled in April compared with previous months.

In response, the PM has instructed the MoIT to check on the increase as well as its impacts on CPI.

In the report, the ministry said the power tariff increase had been submitted to the Government for approval.

It said increasing input prices of coal and gas, along with the foreign exchange rate difference, made electricity production costs increase by VNĐ20 trillion. Of which, coal added more than VNĐ7.33 trillion while oil and gas added VNĐ7.39 trillion.

The ministry also said the current different pricing scheme for households and businesses was also being applied around the world. However, the scheme would be recalculated to ensure fairness among households.

The MoIT also added that EVN had followed the correct procedures in calculating power bills.

The group received and answered more than 71,500 requirements from customers relating to electricity bills in April.

At the 7th session of the 14th National Assembly (NA) which opened in Hà Nội on Monday, the NA asked the Government to report on recent increase of electricity and petrol prices and their effects on CPI and socio-economic development.

Deputy PM Trương Hoà Bình said authorities had been investigating and clarifying the increases to ensure transparency.

EVN’s chairman Dương Quang Thành said the group was building a pilot plan for the competitive electricity retail market it would submit to the MoIT for approval in July.

Thành said they had been working to privatise three power generation corporations and developing a National Load Dispatch Centre (NLDC). They would also privatise its retail power service for the electricity retail market by 2021.

“EVN completed its plan to turn NLDC into a one member limited company and will submit it to the PM for approval,” he said.

He added that EVN would complete a plan to separate power distribution and retail toward the establishment of a competitive electricity retail market.

In addition, it would invest in power market infrastructure to accelerate the market’s development.

Power consumption surges

Last Saturday, power production topped 36,000MW for the first time, according to EVN’s National Load Dispatch Center (NLDC). Consumption on the same day reached a record-high 756.9 million kWh.

EVN said consumption could go up to 800 million kWh per day during May and June as the weather gets hotter.

Summer heat intensifies while water shortage constrains power production

Last month, Việt Nam broke its national high temperature record as the mercury hit 43.4 degrees Celsius in Hà Tĩnh Province, according to French meteorological agency Meteo France. Weather experts have warned that Việt Nam should brace for more heat waves this summer.

Meanwhile, electricity production is facing challenges as reservoirs in the central and southern regions are low on water.

Despite these challenges, EVN has guaranteed that it will supply enough electricity this year. — VNS