will prepare a detailed plan for the International Atomic Energy Agency (IAEA) on how it could embark on a nuclear power programme, its

chief said on Wednesday, backing a push for the country to tap nuclear energy.

–

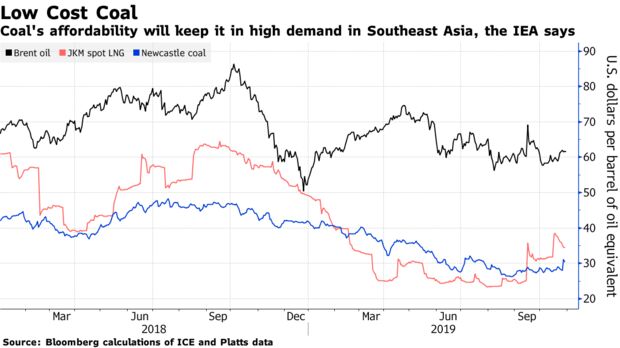

There’s just no stopping coal in Southeast Asia. Surging investments in wind and solar energy won’t be enough to shake the fuel’s dominance in the region for decades to come, according to the International Energy Agency.

Coal demand is expected to double to almost 400 million tons a year by 2040, the agency said in its Southeast Asia Energy Outlook published Wednesday. That’s 2.5% higher than its forecast from two years ago, even as renewable power capacity is seen more than tripling through 2040.

“Coal is rather resistant because it is affordable,” said Keisuke Sadamori, IEA’s director for energy markets and security. “It’s really hard for Southeast Asian countries to move away from affordable coal immediately.”

The main reason for coal’s continued importance in the region is expectations for massive overall energy demand growth as populations continue to increase and become wealthier. Even though new renewable energy capacity is forecast to be installed at about twice the rate of coal through 2040, fossil fuels will still represent about 75% of total energy demand in 2040, according to the IEA.

Almost 100 gigawatts of new coal-fired capacity is set to come online in Southeast Asia, mainly in Indonesia, Vietnam and Malaysia. Around 30 gigawatts is already under construction.

Southeast Asia is also home to the world’s largest exporter of coal, Indonesia. While the country’s low cost of production has allowed it to boost exports, a growing share of output will increasingly serve rising domestic demand. It will be overtaken by Russia in terms of export volumes by 2040, IEA said.

The outlook can change if governments adopt more renewable-friendly policies, Sadamori said. For a start, approved solar and wind projects are outpacing coal this year for the first time ever, which suggests an inflection point for the region.

“We are seeing some positive signs,” Sadamori said. “We hope it’s not a blip.”

–

SINGAPORE: Southeast Asia could become a net importer of fossil fuels in the next few years, raising the financial burden on governments and increasing carbon emissions in the region, the International Energy Agency (IEA) warned in a report.

This comes despite expectations of slower growth in the region’s energy demand as economies shift towards less energy-intensive manufacturing and services, and greater efficiency, the agency said in its annual Southeast Asia outlook.

Southeast Asia was already a net oil importer at 4 million barrels per day (bpd) in 2018, while strong growth in demand for natural gas has reduced the surplus of gas for export, the world’s energy watchdog said.

For coal, output from the region’s top producer, Indonesia, remained well above 400 million tonnes of coal equivalent last year but increases in domestic demand and exports to China and India could reduce its surplus, the IEA said.

“These trends point to Southeast Asia becoming a net importer of fossil fuels in the next few years,” the agency said.

The region’s overall surplus of supply over demand at 120 million tonnes of oil equivalent (mtoe) in 2011 had been eroded to just above 30 mtoe in 2018, it said.

Growing reliance on imports also raises concerns about energy security, the IEA said. For example, the region’s overall dependence on oil imports is forecast to exceed 80 per cent in 2040, up from 65 per cent today.

With no change in policy, Southeast Asia’s energy demand is expected to grow by 60 per cent by 2040, accounting for 12 per cent of the rise in global energy use as its economy more than doubles, the IEA said. This was slower than the region’s 80 per cent growth since 2000.

Southeast Asia’s growth in electricity demand, at an average of 6 per cent per year, has been among the fastest in the world, the IEA said. Still, some 45 million people there still lack access to electricity. The region is well on the way to achieving universal access to electricity by 2030, it added.

Oil demand in Southeast Asia, home to nearly 10 per cent of the world’s population, would surpass 9 million barrels per day (bpd) by 2040, up from just above 6.5 million bpd now, the IEA said.

“Oil continues to dominate road transport demand, despite an increase in consumption of biofuels,” the IEA said.

“Electrification of mobility, with the partial exception of two and three wheelers, makes only limited inroads. This pathway suggests little change in Southeast Asia from today’s congested roads and poor urban air quality.”

Demand for coal is also projected to rise steadily over the coming decades, largely fuelled by new coal-fired power plants, despite headwinds facing such projects that include increasing difficulty to secure competitive financing for new facilities.

The IEA said the region’s increasing reliance on imports of natural gas made the fuel less price-competitive though it appeared to be a good fit for the fast-growing cities and lighter industries in the region.

“In our projections, it is industrial consumers rather than power plants that are the largest source of growth in gas demand,” the IEA added.

Renewable energy is set to play a larger role, but without stronger policy frameworks the share of renewables in power generation would rise only to 30 per cent by 2040, from the current 24 per cent, the IEA said.

Wind and solar energy are expected to grow rapidly, while hydropower and modern bioenergy – including biofuels, biomass, biogas and bioenergy derived from other waste products – would remain the mainstays of Southeast Asia’s renewables portfolio.

Read more at https://www.channelnewsasia.com/news/business/fossil-fuel-southeast-asia-importer-12046080

–

will prepare a detailed plan for the International Atomic Energy Agency (IAEA) on how it could embark on a nuclear power programme, its

chief said on Wednesday, backing a push for the country to tap nuclear energy.

said, after receiving an IAEA review report on the infrastructure the country would need for a nuclear programme.

“This is the beginning of a new phase of work because we have to prepare now our plan of action and we are going to present it to them, to IAEA, and they are going to audit us,” Cusi said.

The Department of Energy has been studying the use of nuclear power, a divisive issue in the Philippines due to safety concerns. It has drafted an executive order, which is awaiting President Rodrigo Duterte’s signature, outlining a national policy to support its plan.

Duterte has said safety will be his top consideration in deciding whether the country will pursue nuclear energy.

Cusi said Duterte “wants to learn more” about nuclear energy.

Nuclear power is seen as a potential answer to the Philippines’ twin problems of precarious supply and the high cost of electricity, although Cusi said other options were also being considered.

“We are looking at all sources of energy. We’re studying hydrogen,” he said. “We are hungry for power and we will tap any sources that would satisfy our own needs now.”

Supporters of Cusi’s nuclear energy push say that because the fuel cost is lower, electricity rates will drop. But those against it cite a reliance on imported uranium, high waste disposal and decommissioning costs, as well as safety issues.

, built in the 1980s but mothballed after a change in the country’s leadership and the devastating Chernobyl disaster.

Cusi said the government is also looking at deploying small modular nuclear plants to some of the country’s islands still suffering from power shortage.

The government recently signed a memorandum of understanding with Russian state atomic company Rosatom involving a pre-feasibility study for such plants, he said.

–

International energy experts believe the share of renewable energy in Indonesia will exceed that of fossil fuel within the next 25 years despite slow progress in ongoing efforts to promote clean energy. Bloomberg’s latest New Energy Outlook (NEO) predicts Indonesia will generate more renewable energy than fossil fuel by 2045 as green technology becomes widely available. Bloomberg New Energy Finance (BNEF) head Jon Moore said renewable energy and fossil fuel would each make up about 50 percent of the country’s energy mix within the next two decades. He predicted green energy would take off by 2045 and significantly exceed fossil fuel by 2050. “At first, Indonesia will develop geothermal and hydropower plants.

–

Singapore — Russia is expected to overtake Indonesia as the biggest exporter of coal by 2040, as the Southeast Asian country’s thermal coal production stagnates, the International Energy Agency said Wednesday.

In the report, IEA Southeast Asia Energy Outlook, released at the Singapore International Energy Week 2019, the agency said that with stagnating investment in coal mines in the 2020s, Indonesia will likely see its output decrease through 2030.

Indonesia is the world’s largest thermal coal exporter and accounts for almost 90% of Southeast Asia’s coal production, IEA said in its report.

The IEA stated that in its outlook scenario, Indonesia’s exports are likely to decline from 350 million mt of coal equivalent presently to 210 million mt of coal equivalent in 2040.

The outlook scenario is based on present day policy framework, the report noted.

“A growing share of production is destined to serve increasing domestic demand, while output declines by 14%,” it said.

However, the report highlighted that Indonesian suppliers might also respond rapidly to price signals from international markets and ramp up production and exports when seaborne prices become more attractive.

ROBUST DEMAND

The report noted that with the volume of coal traded in the world projected to stay broadly flat up to 2040, Australia and Russia are well-positioned to increase exports to offset the reduced role of Indonesia, which serves Asian markets predominantly.

“By 2040, Indonesia is overtaken by Russia in terms of export volumes,” the report said.

Russia, the world’s third largest coal exporter, aims to boost coal exports to Asia amid falling demand in Europe.

The country’s thermal coal production is set to grow by more than 100 million mt to 550 million mt by 2035, as the country looks to invest in new coal infrastructure and focus increasingly on the growing Asia-Pacific region.

According to the September edition of Australia’s Resource and Energy Quarterly, Russia’s thermal coal exports grew by 9.1% to 173 million mt in 2018 and have continued to grow in 2019, although at a slower pace.

While the trend for global coal demand is expected to stay flat, the IEA report highlighted that Southeast Asian demand for coal is robust, doubling to nearly 400 million mt of coal equivalent by 2040 at an annual average growth rate of 3%.

“Based on today’s policies and plans, coal is set to retain a strong position in the region’s electricity generation mix,” it said.

“Over the projection period, strong demand increases in Southeast Asia (excluding Indonesia) outpaces production growth and imports increase to some 170 million mt of coal equivalent by 2040.”

The Singapore International Energy Week, organized annually by the Singapore Energy Market Authority, is held from October 29 to November 1.

–

The Yangon Electricity Supply Corporation (YESC) will be solely responsible for maintaining all streetlights in the region and will change the current lights to more efficient LED ones, Daw Nilar Kyaw, Minister for Electricity, Industry, Transport and Communication, said on September 26.

The announcement came as a response from Daw Thet Htar New Win, Member of Parliament for Thaketa township at the Yangon Hluttaw.

“We would like to make these changes in other townships, but start with Thaketa. Our plan is to replace the old lights and install the new LED lights throughout the city. We have transferred moneys from the YCDC budget to YESC to help fund the plan,’ Daw Nilar Kyaw said.

Last year YCDC set aside money for electricity, and upgrades to the streets and roads, but that left less of the available budget for street lighting.

She said the Yangon Region government is implementing the plan on the main roads, and hopes to complete the initiative by the end of the financial year.

LED stands for “light emitting diode”, and differ from older incandescent bulbs in that they produce light when a current flows through the diode. In LED lights the light source is built into the main fixture, meaning that the light source doesn’t need to be replaced as often.

The older-style concrete electricity polls, with street lights attached.

The older-style concrete electricity polls, with street lights attached.

LED street lights have a higher installation cost, but have become a more feasible alternative as technology has improved over the past decade. Some electrical engineers argue that LED lights only provide directional light, and so cannot provide an overall glow over a street or road. With good designs, however, this can be solved by aiming the lights down towards the area most needing light. A good design may also modify the problem of light pollution, and prevent glare for cars and pedestrians.

Yangon is not the most illuminated city, by any stretch of the imagination. Some lampposts and electricity poles are made from brittle concrete, and easily become damaged when cars crash into them. The announcement by the government seems like a welcome move to change things, and to brighten the streets and roads of the city.

It seems likely that, after the trial installations in Thaketa, the inner city will receive the first upgrades. Hopefully the new lights will make it safer to walk the streets in the evening and at nights, when the prospect of tripping over a wonky paving slab or hole in the pavement are all too much of a worry for many.

The Yangon Region government is also implementing a three-year electricity upgrade, which aims to deliver a more reliable supply of power to Dagon Seikkan, South Dagon and other townships outside of the municipal center.

All these upgrades are well and good, and no doubt will be welcomed by the city’s rate payers. However, without a continuous flow of electricity – throughout the year, and during the day and night – plans to light up the streets won’t be quite as impressive.

–

GE, the high-tech energy, health and aviation equipment provider, has plans to expand its reach in the Myanmar energy and healthcare sectors.

“Myanmar has huge potential in terms of revenue and orders for GE. Myanmar needs healthcare and a lot of electricity. There are good prospects in natural gas production and solar energy sector,” Mr Wouter Van Versch, President and chief executive of GE Asia Pacific, told the Myanmar Times during a visit to the company’s John F. Welch Technology Center (JFWTC) in Bangalore, India this month.

Mr Wouter added that “in the future, GE may come to Myanmar to invest in factories to support its expansion into healthcare and electricity production from natural gas.”

After US sanctions were lifted on Myanmar in 2012, GE was one of first US companies to return to the country in 2013, when it signed a contract with state-owned Myanmar National Airways to support the airline’s upgrade and expansion by providing fuel-efficient engines for six Boeing 737-800 and four Boeing 737-8MAX aircraft.

The company also provides gas turbines and supporting technology to modern power plants in Myanmar, including the US$310 million, 225-megawatt Sembcorp Myingyan gas power plant in Mandalay, which was completed this year by Singapore’s Sembcorp Industries. The plant will generate power for up to 5.3 million people and is among the largest in the country.

GE is also working with the government and private sector to develop the infrastructure and solutions needed to meet healthcare needs in the country. With only 1,056 hospitals and very few private hospitals to support the country’s growing population, healthcare services are still lacking in Myanmar, Mr Wouter said.

Currently, GE’s healthcare products and solutions in Myanmar include the Revolution ACT, a CT scanner that reduces scanning time and x-ray magnitude by up to 36 percent. It was first introduced in Myanmar in 2016 and there are around 150 units now installed in Myanmar, which is the same number as in Vietnam.

The company has also deployed its Lullaby heater, reanimation and photo-scanners, which help detect the early sign of infant mortality, in Myanmar. “Infant mortality rate is still very high in Asean countries like Myanmar and Laos. For every 1,000 new born babies, 47 do not survive,”Mr Wouter added.

Around 2,000 Lullabies have been installed in Asean and the main markets are Thailand, Indonesia, Malaysia, the Philippines and Myanmar. Meanwhile, an additional 4,800 Lullaby LED PET units, which treats neonatal jaundice by reducing bilirubin in the blood, have been installed in the region, of which 1,615 units are in Myanmar.

Following the appointment of Sea Lion as a joint venture partner, GE has also contributed to the upgrading of clinical training courses for medical professionals in Myanmar and channeled up to US$7 million in education and other corporate social responsibilities in the country.

Moving forward, GE will continue to invest across the Asean region. “The region needs much more infrastructure in aviation, energy and healthcare. We can see a lot of potential. In the next 20 years, we expect spending on aircraft, energy and healthcare facilities to rise two folds compared to now,” Mr Wouter said.

Much of that expansion will be supported within the JFWTC, where some 5,300 scientists and engineers are now working at developing new technologies in the medical energy and transportation industries. This includes intelligent machines which can offer real-time solutions, Mr Wouter said. – Translated

–

Prime Minister Prayut Chan-o-cha says he will “take responsibility” for the dispute with an Australian company involving a gold mine he shut down three years ago, but has yet to make the decision.

At the cabinet meeting on Tuesday, Energy Minister Suriya Jungrungreangkit reported the progress of the arbitration between Kingsgate Consolidated and Thailand that began in late 2017.

The Chatree mine in Phichit and Phetchabun provinces, operated by the Kingsgate subsidiary Akara Resources Plc, was ordered to suspend production in late 2016 on grounds that its activities were harmful to the environment and area residents’ health.

The order was made by Gen Prayut under Section 44 of the interim constitution, which grants him unlimited executive powers with impunity after the 2014 military coup.

Kingsgate has consistently disputed the findings of reports that its activities resulted in toxic leaks that affected groundwater and local paddy fields.

Kingsgate has since entered into an arbitration process with Thailand under the Thailand-Australia Free Trade Agreement (Tafta). The company said the government’s order was unlawful under the trade pact and caused substantial damages.

On Tuesday, the Energy Ministry proposed four options to the cabinet: (1) paying Akara Resources to shut it down; (2) complying with Akara’s demands to avoid paying; (3) waiting for the ruling of the arbitrator and abiding by it; and (4) partially paying the damages and then allowing the mine to reopen.

Some ministers did not agree with the last option, viewing if the government had already shut down the mine, it would be inappropriate to allow it to reopen.

While the meeting was discussing the issue, Gen Prayut said he needed time to think. “I can’t decide now but I’ll bear all the responsibility,” he said.

Interior Minister Anupong Paochinda said Thailand should wait for the ruling while Finance Minister Somkid Jatusripitak made no comments.

Chatree was Thailand’s biggest gold mine, employing almost 1,000 workers. The open-cut mine began production in 2001. Its concession was due to run until 2028.

Since Gen Prayut used his special power to shut it down, a question followed who should pay the damages, believed to be 36 billion baht, should the arbitrator decide in Kingsgate’s favour.

They link the Chatree case with the status of Gen Prayut as “state official”. In their view, if Gen Prayut is a state official, the Thai government must pay the Australian company. But if he is not, Gen Prayut should pay the claims out of his own pocket.

The status of Gen Prayut was questioned before he became the prime minister after the March 24 election. The charter says a prime minister must not be a “state official”. Some people believed Gen Prayut was a state official because he received salaries from the state and asked the Constitutional Court to rule.

The court decided Gen Prayut was not a state official. As the holder of the sovereign power at the time, he was not a state official and was qualified to be prime minister.

Cholnan Srikaew, a Pheu Thai MP for Nan province, said in Parliament this month the Opposition would review the 2020 budget bill thor