The Asian Development Bank (ADB) plans to invest 5 billion Thai baht (US$155 million) in Thailand-based B.Grimm Power Public Company Ltd via five- and seven-year green bonds. Reportedly, the bonds are the first certified climate bonds issued in the country.

According to the bank, the proceeds have been earmarked for nine operational solar PV plants with a cumulative rating of 67.7 MW, and for an additional 30.8 MW, which are currently still under construction.

“This issuance will foster the development of the green bond market in Thailand by showcasing international best practice for genuine green and climate bonds,” said B.Grimm Power president Preeyanart Soontornwata. “ADB’s support was invaluable to ensure the bonds comply with the International Capital Markets Association Green Bond Principles and Climate Bond Initiative standards, building on a long-standing relationship we have forged through multiple transactions.”

Michael Barrow, director general of ADB’s Private Sector Operations Department believes the green bond will help the country to achieve its goal of reducing greenhouse gas emissions by 20% by 2030.

Overall, the bank lauds B.Grimm’s renewable energy efforts and names it a pioneer of low-carbon growth in Thailand.

B.Grimm is said to be one of Thailand’s largest private power producers. Aside from 15 gas-fired power stations, the company also operates 15 solar assets. In July, the company signed a loan agreement with ADB to expand its renewables portfolio from 10% to 30% of its generation by 2021.

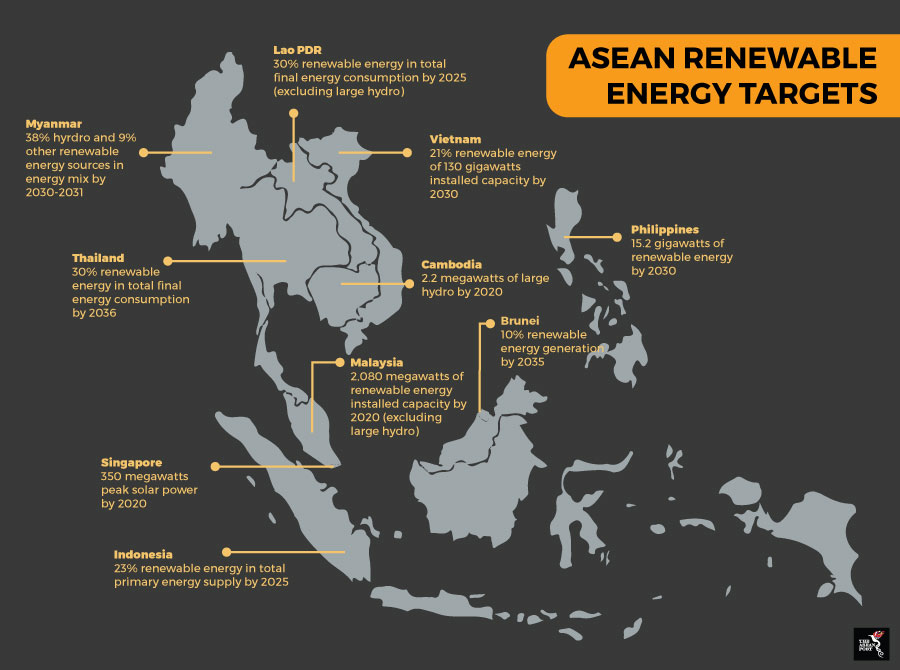

At the time, ADB subscribed to 123 million of B.Grimm’s shares worth 1.968 Thai baht ($57.7 million) and announced that it would administer a loan of another $20 million from the Canadian Climate Fund. The investment was destined for 114 MW of solar PV capacity and 16 MW of wind power, as well as additional projects in Cambodia, Indonesia, Laos, Myanmar, Philippines, Thailand and Vietnam.

Last December, IRENA and the Ministry of Energy of Thailand released a report suggesting that Thailand’s share of renewable energy could surpass its target by 2036.