The Philippines topped the list in terms of environmental sustainability, but lagged in terms of energy security and energy equity, ranking 70th and 96th, respectively.

In the Philippine generation mix, renewable energy has a share of 24.6 percent. But the sad part is we are very poor in energy security and equity, Energy Secretary Alfonso Cusi said.

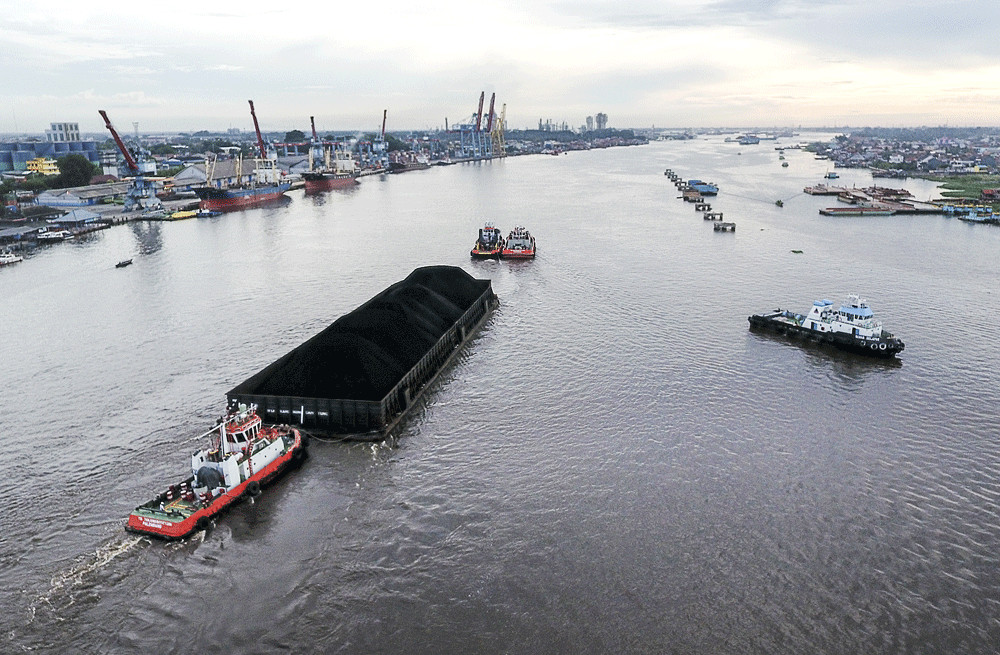

“How do we improve energy equity, energy security, when we are dependent on imported fossil fuel?,” he said.

When the Duterte administration started two years ago, the Department of Energy (DOE) employed a technology-neutral stance in building the country’s capacity to ensure affordable, adequate and reliable power supply while sustaining economic growth.

More than ever, the government is now actively pushing for other energy sources such as the development of the nuclear energy program, liquefied natural gas (LNG) importation and reviving the oil and gas exploration industry.

Push for nuclear

Time and time again, Cusi has been pressing for the inclusion of nuclear power in the country’s energy mix to increase energy security and affordability as he views it as one of the cheapest and cleanest power source.

“if you look at energy equity, our affordability and access is still a problem. We are the most expensive in the Southeast Asian region,” he said.

The Philippines may not see any nuclear power plant in the near term, but this administration is laying down the framework that will again pave the way for nuclear development.

Last April, the DOE submitted to the Office of the President its proposed national position on nuclear energy. Both houses of Congress have also been working on laws to support nuclear energy development.

The House of Representatives approved on second hearing House Bill 8733, or the proposed Comprehensive Nuclear Regulation Act. At the Senate counterpart, Senate Bill 1959 is still pending at the committee level.

But before the country can proceed to introduce nuclear energy in its power mix, an assessment by the International Atomic Energy Agency (IAEA) showed broader stakeholder input and an established regulatory framework are needed.

Clearly, nuclear power lacks social acceptance as shown by the long years of non-support for the mothballed Bataan Nuclear Power Plant (BNPP).

“The [BNPP] is nothing but a relic of a past marred by corruption and mismanagement. It has no place in an energy landscape which is globally shifting towards renewable energy away from extracted fuels, and towards decentralized, diversified systems away from centralized, big energy projects,” the Center for Energy, Ecology, and Development (CEED) said.

Built during the Marcos administration to supply additional power by replacing ageing power plants, the 620-megawatt (MW) BNPP was developed by Westinghouse at an initial cost of P38.4 billion in 1976 but ballooned to P124.2 billion in 1984.

CEED said the project was financed largely by debt from foreign investors, but ended up going to the pockets of Marcos cronies.

The facility was also found to have 4,000 defects upon inspection.

Contrary to claims that the BNPP was built on top of a fault line, several studies and investigations showed otherwise.

Philippine Institute of Volcanology and Seismology (PHIVOLCS) geology and geophysics research and development chief Arturo Daag said the agency has found no evidence of an active fault within the BNPP’s vicinity.

He said this was also the result of studies made by the consortium composed of Russian state-owned Rosatom State Atomic Energy Corp., Slovenia’s Gen Enerjia and global engineering firm Worley Parsons, which even recommended that the BNPP could still be rehabilitated.

Japan’s experience with Fukushima has also promoted more fear in developing nuclear power facilities.

CEED said the Fukushima incident in 2011 had taught us that the damage nuclear facilities could wreak were wide and far-reaching.

“Being among the most climate-vulnerable countries in the Philippines, visited by an average of 20 storms annually, not to mention the fact that we are in the Pacific Ring of Fire which is a haven of seismic and volcanic activity, constructing nuclear power plants anywhere – especially along a fault line – would be begging for disaster to happen,” the environmental research institute said.

With the nuclear push, the DOE seems to be all over the place, Laban Konsyumer Inc. president Victorio Dimagiba said.

“I thought they are heavy on renewables and had launched accelerated exploration of indigenous resources. We are already left behind in nuclear energy,” he said.

The DOE should, instead, focus on developing the renewables sector and on tapping indigenous sources.

LNG terminal vs. exploration

The DOE is also aggressively pushing for the development the country’s LNG terminal to replace the Malampaya gas facility, whose contract is expected to expire in 2024.

According to the government, LNG represents a vital national infrastructure that is needed to maintain and enhance the country’s energy security when the Malampaya gas field is eventually depleted. This as the Malampaya project supports the 3,500 MW gas-fired power plants in Luzon.

Moreover, the LNG facility is also targeted to become an LNG hub for Asia, complementing those in Japan and Singapore.

Originally, the LNG terminal was targeted for construction by the middle of the year. The target was pushed back to mid-2019.

It was only in December 2017 when the DOE issued the Philippine Downstream Natural Gas Regulation (PDNGR), which details the rules and regulations governing the downstream natural gas industry to develop a market and gain energy security and sustainability.

Under the PDNGR, the DOE is accepting proposals from companies interested to build the LNG terminal.

First to submit was the team-up of businessman Dennis Uy’s Phoenix Petroleum Philippines Inc. and China National Offshore Oil Corp. (CNOOC).

Only until recently, FGEN LNG Corp. of the Lopez group submitted its application for its planned LNG terminal in Batangas in partnership with Tokyo Gas Co., Ltd.—Japan’s largest natural gas utility.

A number of other parties expressed their interest to be part of the country’s LNG terminal but have yet to submit their formal proposals.

But Cusi said the DOE hopes to pick the entity that will build the country’s LNG terminal by the end of the year.

However, Shell Philippines Exploration B.V. (SPEX)—the lead operator of the Malampaya project—said there would be no need for an LNG terminal if there would be other indigenous sources discovered.

SPEX is advocating for the exploration and development of indigenous resources.

“That needs to be evaluated. The risk of LNG terminal is who will be your customer. Indigenous always trumps terminal,” Shell Philippines country manager Cesar Romero said.

A report by Fitch Solutions Macro Research said the Philippines’ self-sufficiency in natural gas would end in 2019, with the completion of its first LNG import terminal under Hong Kong-based power and utilities firm Energy World Corp. (EWC).

Planned since 2011, EWC’s Pagbilao LNG suffered numerous delays due to issues ranging from volatile LNG prices, funding, regulatory obstacles and confusion over transmission arrangements.

But since the Philippine government has declared the project as an energy project of national significance, “this likely puts the project on track to begin commercial operations within 2019, eight years after it broke ground,” Fitch Solutions said.

As the lead operator of Malampaya, SPEX is willing to take that strategic bet of discovering another Malampaya and further lengthen its 100-year investment in the Philippines only if there was clarity in the fiscal regime.

Romero said the company is looking at various territories outside Service Contract (SC) 38 or the Malampaya project especially if there is clarity in the fiscal regime.

He was referring to the Commission on Audit’s (COA) decision in 2009 to slap a P53.14-billion tax deficiency from the Malampaya project operated by Shell Philippines Exploration B.V. (SPEX), Chevron Malampaya LLC and the Philippine National Oil Co. Exploration Corp. (PNOC-EC).

Meanwhile, the Tax Reform for Attracting Better and High-Quality Opportunities (TRABAHO) bill seeks to rationalize fiscal incentives, which may repeal the perks under Presidential Decree No. 87, or perks to promote the discovery and development of the country’s indigenous petroleum resources.

Shell remains interested in exploring the Philippines and investing existing and new fields.

This as the DOE launched the Philippine Conventional Energy Contracting Program (PCECP), dubbed as “Explore, Explore, Explore,” in November.

The PCECP is a revised the investment mechanism which provides a more investor-friendly environment which is consistent with the directions set by President Duterte.

It offers 14 pre-determined areas (PDAs), and the option for investors to propose their own exploration area, making oil and gas exploration a dynamic investment prospect for players in the energy sector.

DOE hopes to reignite interest in the exploring the country’s untapped potential and to solve the country’s energy security woes.

President Duterte stressed the need for more explorations, noting the “country remains underexplored” and has “become dangerously complacent with importing the bulk of our petroleum requirements.”

The Philippines needs new energy sources amid the increasing power demand, depleting indigenous resources and adverse impact of volatile international markets, Cusi said.

“We could no longer be complacent and subject ourselves to the volatility of the global oil markets. It is high time we establish a sustainable petroleum exploration and development program,” the DOE secretary said.

From this activity, the agency has generated 13 interested applications for the 14 PDAs while eight parties have nominated new areas for oil and gas exploration activities.

Currently, there are only 23 active Petroleum Service Contracts (PSC) in the country, with the Malampaya deep water gas-to-power project as the most successful PSC stemming from the previous Philippine energy contracting round.

Cusi said the country has only drilled an average of five wells in a 10-year period compared with the double and triple digit averages of other ASEAN countries.

“With the success of our ASEAN neighbors in their energy exploration activities, we deem it our priority for local exploration to flourish as we are driven to make sure that the demand for energy is met. We see that the program will offer positive contributions to our economy as a direct result of exploration-related investment,” Cusi said.