- Oil & Gas

–

- Vietnam

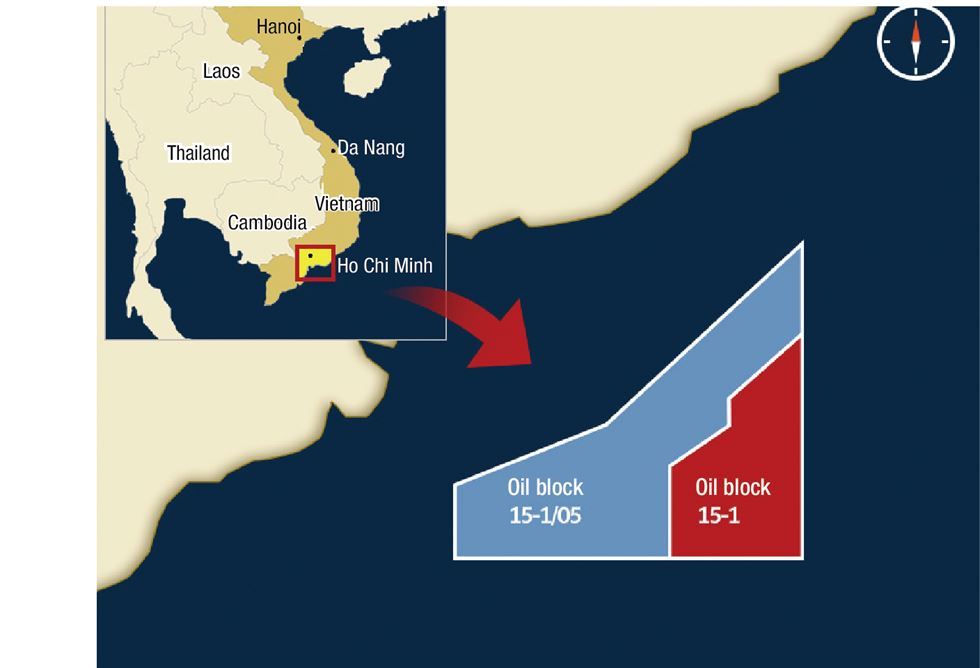

SK Innovation has discovered a new oilfield in the Cuu Long basin located in southeastern Vietnam, the company said, Friday.

The energy business arm of SK Group said its exploration team found a 116-meter-thick oil layer after drilling 4,295 meters in Block 15-1/05 in Lac Da Trang in the basin.

Further analysis will be required to figure out the size of the oil discovery and whether it is commercially viable.

Block 15-1/05 is adjacent to Block 15-1 in the same basin, where SK Innovation initiated its commercial oil production in 2003.

In February 2007, SK Innovation signed an extraction contract with the Vietnamese government for Block 15-1/05.

In 2015, SK Innovation confirmed that the block had enough oil reserves in Lac Da Vang near Lac Da Trang for commercialization after producing up to 2,450 barrels per day during tests.

The Lac Da Vang development team then announced its plan to commercialize the oil field in January, 2018 and production is expected to take place in 2021.

The company holds a 25 percent stake in Block 15-1/05 while U.S. crude oil producer Murphy has 40 percent and Vietnam’s state-owned oil firm PVEP holds 35 percent.

“Vietnam is one of the most important countries for us, and we are actively implementing exploration and production activities there,” a SK Innovation official said.

“We aim to strengthen ties with the Vietnamese government and PVEP to become the largest foreign refiner in the Cuu Long basin,” he said.

As of the end of 2018, the company produces about 53,000 barrels of crude oil and natural gas per day from 13 oil and gas fields in nine countries and through four LNG projects.