Menu

ASEAN Centre for Energy (ACE), in collaboration with the Ministry of Energy of Brunei Darussalam, and Brunei Climate Change Secretariat (BCCS), supported by the ASEAN Climate Change and Energy Project (ACCEPT), convened a webinar on Energy and Climate Outlook in ASEAN under Brunei’s Chairmanship: Green Recovery Post Pandemic. The webinar explained the outlook of energy and climate change in ASEAN and the priorities of Brunei Darussalam’s Chairmanship ASEAN energy cooperation in 2021, specifically the synergy with Paris Agreements and Sustainable Development Goals (SDGs). The discussion was based on the 6th ASEAN Energy Outlook (AEO6), the COVID-19 Energy Insight Series, and the recent Nationally Determined Contributions (NDC) of Brunei Darussalam. With Brunei’s theme of “We Care, We Prepare, We Prosper”, ASEAN is determined to address energy and climate issues, ensuring green recovery and a sustainable future.

Attended by 224 participants, the webinar started with the opening by moderator Ms. Monika Merdekawati, the Officer of Sustainable Energy, Renewable Energy, and Energy Efficiency (REE) Department of ACE, who was also the Research Analyst of ACCEPT. Subsequently, the welcoming remarks were delivered by Dr. Nuki Agya Utama, the Executive Director of ACE; Mr. Abdul Salam Haji Abdul Wahab, Head of Sustainable Energy Division, Ministry of Energy of Brunei Darussalam; and H. E. Gunn Jorid Roset, Ambassador of Norway to Malaysia and Brunei.

Mr. Wahab stated in his welcoming speech, “with the world is facing the global challenge with the ongoing pandemic COVID-19, it is crucial more than ever that we are together towards achieving the most sustainable and resilient energy sector and towards the region’s economic recovery. We also need to take consideration of the impact of our sector on climate change”. He also believed that one of the key deliverables of achieving a low carbon energy future includes promoting the role of natural gas, one of the cleanest fossil fuel options. The demand for energy in the regions highlights the importance of natural gas to be incorporated into the overall energy mix to meet the energy supply’s needs due to its accessibility, efficiency, and price.

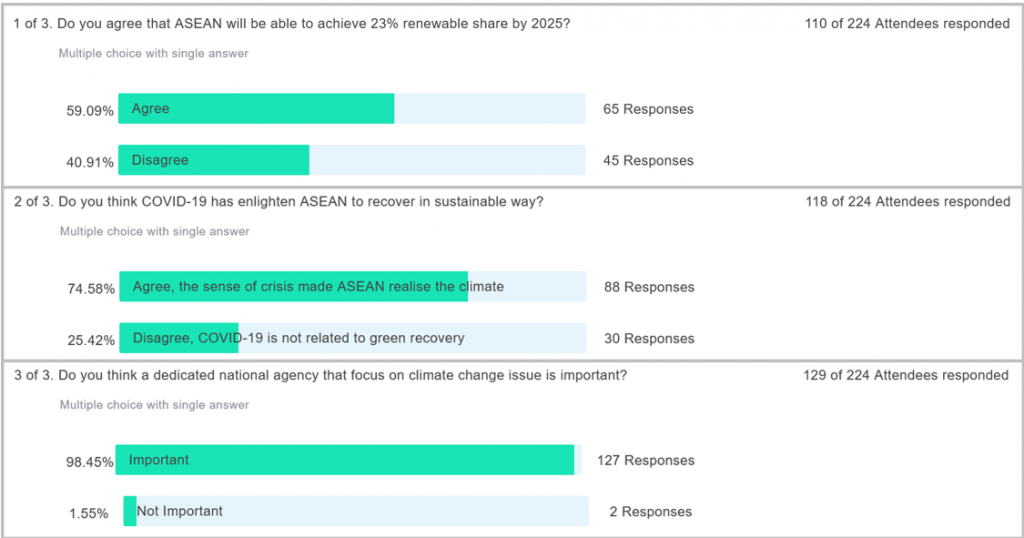

Before entering the first presentation, the moderator invited the audiences to participate in an interactive poll, “Do you agree that ASEAN will be able to achieve 23% renewable energy share by 2025?”. The answers showed about 59% of the participants agreed, while 41% disagreed. The first presentation then was given by. Ms. Iqlima Fuqoha, Officer of Energy Policy Planning and Modelling/Modeller of the AEO6, ACE. Her presentation with the title “Energy and Climate Change Outlook in ASEAN – Insight from AEO6” was expected to answer the initial question in a bigger picture.

Ms. Fuqoha delivered some key findings on how the ASEAN energy sector was out looking a missing part on the climate-related issue, based on the AEO6 launched by the 38th ASEAN Ministers on Energy Meeting (AMEM) in November last year. AEO6 consists of four main elements, namely Background, Scenarios, Thematic Energy Insights, and Policy Recommendation. The first element provides background information on the current ASEAN energy landscapes, challenges, collaborations, and the role of AEO6 to support the energy transition pathways in achieving the regional target, outline in the ASEAN energy blueprint, known as the ASEAN Plan of Action for Energy Cooperation (APAEC). Secondly, AEO6 was built based on different sets of the national regional target and the respective policy. Furthermore, AEO6 provides thematic energy insights to bring a global perspective on how they could benefit the regional development. Finally, AEO6 provides policy recommendations for the ASEAN Members States (AMS) on the energy policy and the collaborations needed.

Based on the projection, ASEAN’s energy demand continues to grow to reach around 1000 Million Tonnes of Oil Equivalent (Mtoe) under the baseline scenario by 2040, with fossil fuels still dominates. However, if AMS have more stringent energy efficiency measures supported by regional cooperation, energy efficiency best practices or energy labelling standards, they could push towards energy savings. Meanwhile, renewable energy adoption will be scaled up, such as higher biofuel blending ratio and more extensive deployment of a solar rooftop. Saving from the demand sides will impact the required energy supply itself. By the end of the projection year 2040, ASEAN could reduce the supply from 1600 Mtoe to only 1100 Mtoe. To achieve both national and regional targets, decarbonising sector becomes crucial. The APAEC targets require renewable energy to grow larger than the stated individual countries’ power development plan.

The next presentation was from Ms. Nadhilah Shani, the Officer of Power, Fossil, Fuel, Alternative Energy, and Storage, ACE. In her presentation with the theme “The Highlight from ACE COVID-19 Energy Insight Series“, Ms. Shani covered several talking points that highlighted the pandemic’s effect on the ASEAN energy sector: oil and gas, electricity, renewables, and 2021 energy sector outlook. She began explaining how unprecedented the COVID-19 impact was on Southeast Asian economic growth. With most AMS facing unprecedented economic challenges, she mentioned that the energy sector’s effect, particularly in the oil and gas sector, was simply miserable. The pandemic resulted in plunged demand, supply glut, and plummeting prices, forcing the industry to cut refinery and disarranged explorations. Despite the miserable condition in the first half of 2020, the second semester showed more optimism when the energy sector slowly recovered and showed resiliency as the movement restriction was slowly lifted. That positive news comes as energy demand and exploration gradually increased, especially Liquid Natural Gas (LNG) and energy explorations in AMS such as Vietnam resumed.

Unprofitable conditions also grasped the electricity sector with shrunk electricity demand. She then stated that even though electricity demand rebounded in the second half of 2020, the future demand remains uncertain, and stalled power projects sparked the need to re-evaluate and re-orient the masterplan and coming project. To overcome these conditions, AMS launched stimulus packages to help eased electricity consumers’ financial burden. Member states also started to prioritized and re-focusing recovery using RE projects. At the end of her presentation, Ms. Shani stated four factors that will influence the ASEAN energy sector in 2021: (1) vaccines, (2) more substantial climate commitment among AMS, (3) power sector transformations, and (4) the international energy agenda.

The sessions shifted to focus on Brunei Darussalam’s chairmanship priorities on energy and climate change presented by Ms. Dina Yahya, Head of Brunei Climate Change Secretariat (BCCS) Brunei Darussalam. She mentioned several progressive deliverables of the region in 2021. These include a commitment to the blue economy, ASEAN joint declaration on energy transitions and security, circular economic framework, the recommendation for regional cooperation for mineral intensive-low carbon and digital future, and joint statement during the 26th United Nations Climate Change Conference.

Later, Ms. Yahya shared ten proposed priorities under Brunei’s chairmanship for the 39th AMEM. In line with the 2021 deliverables, these priorities include a roadmap for development for energy efficiency building-cooling, environment regulatory, development of agreement to advance multilateral electricity trading in ASEAN Power Grid (APG), the completion of phase 1 and 2 of the ASEAN Interconnection Masterplan Study (AIMS) III, and recommendation for ASEAN Energy Regulators Networks (AERN). Other priorities include a workshop on Hydrogen economy and Carbon Capture and Storage (CCUS), a concept paper on AMEM-wide education, and ASEAN energy establishment and climate change organizations cooperation on energy issues. Lastly, Ms. Yahya presented Brunei’s own climate change policy, which contains ten programs covering sustainable industry improvement, enhancing environmental protection, education and awareness among the public, and transforming power generation toward cleaner and more sustainable sources.

After three (3) insightful presentations, the webinar continued with very fruitful questions and answered sessions. This session discussed questions surrounding battery storage potential in ASEAN, Indonesia’s current RE situation, and the implementation of carbon pricing in Brunei Darussalam. All speakers gave their thought on the matters and shared the optimism for a greener and cleaner future for the AMS.

After the last sessions, the webinar was closed by Mr. Beni Suryadi, ACCEPT Project Manager. In his closing remarks, Mr. Suryadi stated that ASEAN countries tried to move toward green recovery because of the pandemic’s impact. While it happens, ACE is committed to providing stable analysis and information to all governments, private sectors, and the public to help the recovery process. He also shared information about the COVID-19 page, which contains updated energy-climate content and woman energy survey 2021 to celebrate international women’s day.

Questions and answers:

Question 1

Renewable energy investment is expected as a core of recovery of the economy from Covid-19. I guess many equipment for renewable are import. Did you analyze the ripple effects on the local economy?

Answer: If we follow the past 2020 news, in some Member States where the import dependency of equipment and materials, such as PV modules, is high, the projects got postponed until certain times due to movement restriction and plants halting the operations. On the other side, solar manufacturers in Malaysia and Vietnam are growing fast to boost deployment, thanks to the government’s supportive policies. However, in the AEO6 scenarios, we did not fully capture the covid-19 implications on a sectoral basis, but more on the macroeconomic scale.

Question 2

The power sector seems to be the key and while renewable energy makes progress, it won’t be able to significantly reduce emissions as fossil fuels still have a large role. Where is carbon capture in all this? How could CCS help the ASEAN region?

Answer: The development of AEO6 involved the Member States’ policymakers and experts from ACE’s partners, also international organisations. From the working group discussion, CCS/CCUS technologies is not yet feasible to implement in the short to medium term in ASEAN, due to its high cost. CCUS will be more favourable if the Member States have put in place carbon tax policies.

Question 3

What is the outlook for battery usage in Utility level power girds? Is this technology being tapped by power sector operators?

Answer: Battery or energy storage system (ESS) outlook will be increasing as the vRE penetration rise. To achieve regional targets in the APS, ASEAN will build 23% vRE of total capacity by 2025. This requires a stable and reliable power grid system, where battery/ESS plays a major role in a smart power supply system. In Thailand, ESS is recently installed with the country’s growing solar and wind development.

Question 4

Thank you for the very clear presentation. In % the transition towards RE is clearly visible. However in absolute numbers (GW), even in the APS scenario, there is an increase of coal-based energy. Why is there no scenario for coal reduction? Thank you, Jan Zwarteveen, Managing Director Siemens Gamesa Renewable Energy Philippines.

Answer: Under the APS, it is assumed that there will be a 10% reduction of coal subcritical capacity by 2025, though. As the Member States also foresee the future coal technologies will shift to the high emission and low emissions (HELE) such as coal supercritical (SC) and ultra-supercritical (USC), so the capacity additions on coal will be coming from SC and USC technologies. In the AEO6 model, the scenarios built based on national and regional targets, and ASEAN commitment to SDG 7. We haven’t explored yet the possibility of decommissioning old coal power plants then to further gradually phasing out coal scenarios in AEO6. Perhaps, that could be something we’ll look up to in the next AEO.

Question 5

How far the Indonesia is engaging investors or business owners to support RE? And do we have a plan to educate local municipalities the importance of supporting climate actions/RE?

Answer: Indonesia has done some effort to attract RE investors through tax incentive support (i.e. tax exemption, duty exemption, etc). The government also collaborate with finance institution (like PT SMI) to help finance more RE and green projects. Basically, the government has put the effort into providing a conducive climate through policy for an investor to invest, especially in making RE in the same level playing field with other conventional sources. However, the effectivity of these policies needs to be evaluated and regularly adjusted to ensure that the support is working. To engage the local municipalities, I have limited knowledge on this, but so far I know that the government has RUED (Rencana Umum Energy Daerah) which is a derivation from RUEN (Rencana Umum Energy Nasional). Through RUED, government translate the national target and break it down to regional target for achieving RE. But, I don’t know whether there are any concrete action plans to implement, following the regional target.

Question 6

RE will require more access to land and space as compared to conventional energy facilities. How and where is RE going to be located, and whose land or what type of land (use) will be affected?

Answer: Yes, it is true to some degree that RE also requires land for energy generation, but whether it needs MORE land compared to conventional energy, is still arguable. Depends on what is RE technology we are looking into and comparing it to. The land issue has a different level of urgency in a different part of the ASEAN region. Some RE like biofuel and biomass has often created a competition issue for land for agriculture in several ASEAN countries like Thailand, Malaysia, and Indonesia. Hydropower also can potentially create issues on water supply and fisheries especially for big hydro which requires a dam. But these issues can be solved if careful and thorough feasibility studies are carried out. Even for conventional energy, land can also create an issue, especially for like coal power plant, where it requires also a big area for power plant.

Question 7

If the extension of Coal capacity is planned, as stated by the UN reports, at a financial loss, how can we plan to address to extend the capacity more in Coal than in renewables even post-2025?

Answer: This is indeed true. Investment for new coal power plant threats the region with stranded asset risk. That is why that ASEAN needs to carefully plan their energy strategy especially if they are incorporating coal in the plan. Several countries in ASEAN have been aware of this risk and put actions already in cutting back coal from their plan, like the Philippines, Malaysia and Vietnam and plan to increase the mix from RE or natural gas. Although other AMS has not yet take the bold step towards coal, they gradually more aware that there is more risk imposed by coal from the fact that financing opportunities also become limited as more and more banks are backing out from coal, which hopefully creates higher awareness of investing on new coal PP, in the long run, is already not an option anymore.

(BA/RN)