Menu

As the most populated country in ASEAN, Indonesia consumed 41% of total energy consumption in the region or equal to 161 Mtoe in 2014 considering the significant economic development and population growth. While at that time the global economy was not in its best period, Indonesia’s energy consumption remained increasing to 164 Mtoe in 2015, from 160 Mtoe in 2014. In 2014-2015, almost all sectors were showing upward trends. Nonetheless, only the transport sector fell as much as 1.4% from 46.8 Mtoe in 2014 to 46.1 Mtoe in 2015. Energy consumption in the industrial sector was up to 6.0%, reaching 42.6 Mtoe in 2015, while at the same time the residential sector recorded a rise of 1.1% from 51.8 Mtoe to 52.3 Mtoe. This was followed by the commercial sector, which was only higher by 0.2% from 5.3 Mtoe in 2014. For the other sectors, Indonesia consumed 17.3 Mtoe in 2015, 3.3% higher from 16.7 Mtoe in 2014.

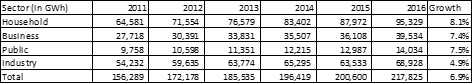

In the power sector, Indonesia led the regional market in term of power generation and electricity consumption. It generated 232 TWh and consumed about 201 TWh in 2015 with the growth of 6.9% in the period of 2011-2016. Throughout the period, household/residential remained a major power consumer which recorded consumption of nearly half of the total. In 2015, the household sector consumed 88 TWh, followed by industry which amounted to 64 TWh, by the business sector at 36 TWh, and the public sector as remainder (Table 1). In this period, the household sector was standing over the other sectors with its 8.1% annual growth, followed by industry and public sectors with similar growth of 7.5%. In 2016, up to November, total electricity consumption in Indonesia was at the level of 218 TWh, while household increased up to 95 Mtoe, the business reached 40 Mtoe, the industry at 69 Mtoe and the public sector had a 1 Mtoe increase from the previous year.

Table 1. Indonesia’s Historical Electricity Consumption in 2011-2016, Electricity Supply Business Plan (RUPTL) 2017-2026

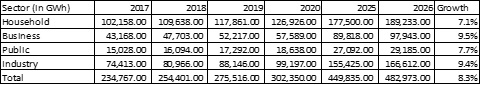

Under the RUPTL 2017-2026, the Government of Indonesia (GoI) has calculated its future consumption up to 2026 by using their forecasted gross domestic product (GDP) and population. The electricity consumption in Indonesia will grow significantly by 8.3% per annum, reaching 483 TWh in 2026. In the same period, the business sector will rise by 9.5% annually, reaching 98 TWh in 2026 from only 39 TWh in 2016. Next, the industry will follow by the pace of 9.4% annual growth, with electricity consumption expected to triple in 2026, from that in 2011, or equal to 167 TWh. It will then be followed by the public sector (consists of government offices, social sector and public lamps) amounted to 29 TWh in 2026, with the annual growth of 7.7% over the period. As a laggard in terms of growth, the household is expected to double from just 95 TWh in 2016 to 189 TWh in 2026 as the major electricity consumption in this archipelago.

Table 2. Indonesia’s Future Electricity Consumption, Electricity Supply Business Plan 2017-2026

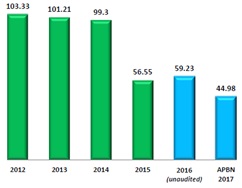

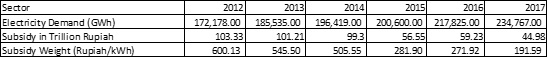

Despite the huge electricity demand, GoI still allocates subsidies in this sector up until today. In the last half of the decade, the GoI’s subsidy for electricity fell from IDR 103.33 trillion in 2012 to only IDR 59.23 trillion in 2016, with the steepest drop between 2014 and 2015. The new national budget arrangement (APBN 2017) also indicates that the new subsidy for electricity sold will be only allocated for IDR 44.98 trillion, which is lower than last year. In the period of 2012-2017, subsidy weight, the ratio between the amount of subsidy and electricity sold to the target of subsidy, reduced from IDR 600.13/kWh to IDR 271.92/kWh. It may drop to IDR 191.59/kWh, as per the APBN 2017 (Table 3).

Figure 1. Government Subsidy in Selling Electricity (IDR trillion), 2012-2017

Figure 2. Crude Oil WTI (NYMEX) in the last five years, NASDAQ Website

Based on Figure 1, a reduction for electricity subsidy was undertaken by the government in 2015 at the same time with the plummet of global crude oil price (see Figure 2). The reason behind this electricity subsidy reduction/reform was from a strong triangle relation between electricity tariff, more effective subsidy programme and global crude oil price. Under electricity tariff equation, global crude oil price and subsidy were two important variables that had a direct effect on the electricity tariff if both changes. Approaching 2015, a fall of global oil price opened an opportunity for the government in reducing the amount of subsidy to the electricity tariff to create more effective subsidy. The cheaper oil price would encourage lower tariff. Or, it might keep the tariff at the previous level but it provided an opportunity for less subsidy. Rather than an electricity tariff reduction (with huge subsidy), the subsidy reduction was a good choice for the government to take away half of the subsidy in 2015 without getting complaints.

Table 3. Subsidy weight for each kWh of electricity sold, the National Team for the Acceleration of Poverty Reduction & PLN 2012 – 2017

Moreover, as written in Ministerial Decree No. 28 and No. 29 in 2016, subsidies should be precisely directed to the people who live below the poverty line. In 2016, the National Utility (PLN) and the GoI concluded that citizens whose electricity capacity are at 900 VA (around 18.7 million people) will not be subsidised by early 2017, which will potentially reduce the electricity subsidy again this year as captured in Figure 1. The tariff for this type of users is adjusted from only IDR 791/kWh in the first stage (January 2017) and to the level price of IDR 1,325/kWh in the third stage (May 2017).

Featured photo credit: TaxFreePremiums.com

References