Menu

Virtual – 24 March 2023

The ASEAN Centre for Energy (ACE) organised an event to officially launch a report titled “Potential Strategies and Financing Opportunities for the Transition to Decarbonisation Pathways in ASEAN“. The report presented findings on the challenges and opportunities that ASEAN member states (AMS) face in transitioning to clean energy and attracting private finance for renewable energy (RE) projects.

The event commenced with opening remarks delivered by Ms. Chen Jing, Director of the International Cooperation Department at CHN Energy. Ms. Chen Jing emphasised the necessity of intensive collaboration in investment, industry, technological advancements, and tenant cooperation within the energy sector. She stated this would contribute significantly to accelerating energy transitions in both China and ASEAN countries. Dr. Nuki Agya Utama, Executive Director of ACE, also provided a welcoming address during this session. Dr. Nuki Agya Utama highlighted the crucial need to achieve the AMS Renewable Energy (RE) share target by 2025. Failure to meet this target would require mobilising a total investment of approximately 160 billion USD for the power sector, with 75% of that amount allocated to renewable energy investments. Both speakers emphasised the importance of collaborative efforts between countries and the active participation of the private sector in achieving the clean energy targets set by ASEAN.

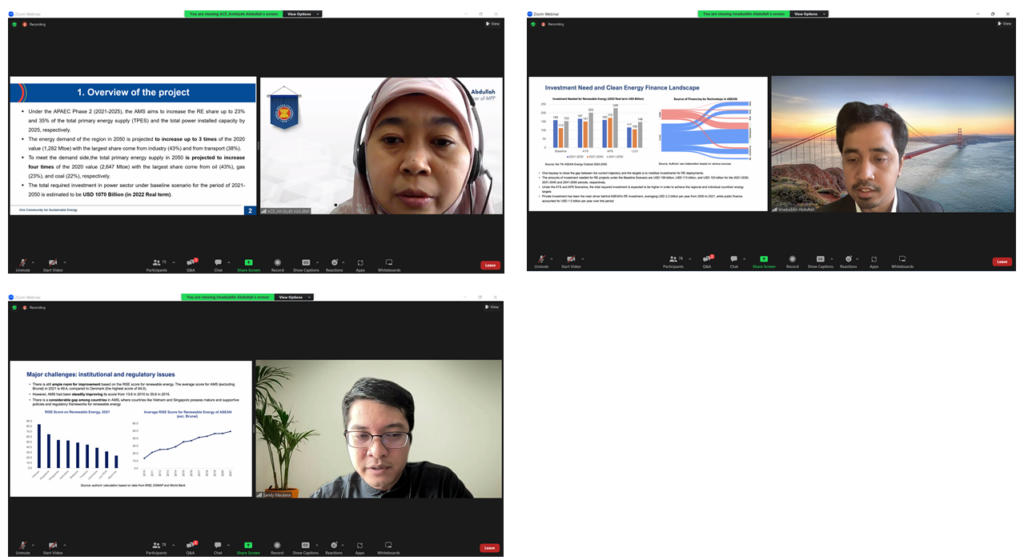

The Introduction to the Report was presented by Dr. Ambiyah Abdullah, Senior Officer of ACE, Mr. Imaduddin Abdullah, Researcher Institute for Development of Economics and Finance (INDEF), and Mr. Sandy Maulana. Dr. Ambiyah Abdullah explained a summary of the report and emphasised the key points of the report, including the fiscal budget re-arrangement required to provide more space for RE public investment.

The Introduction to the Report was presented by Dr. Ambiyah Abdullah, Senior Officer of ACE, Mr. Imaduddin Abdullah, Researcher Institute for Development of Economics and Finance (INDEF), and Mr. Sandy Maulana. Dr. Ambiyah Abdullah explained a summary of the report and emphasised the key points of the report, including the fiscal budget re-arrangement required to provide more space for RE public investment.

Mr. Imaduddin Abdullah dives deeper into the report by explaining the trend of economic recovery, current landscape of clean energy and the energy mix targets, which leads to the investment needed and the clean energy finance landscape. He also highlighted the investment gap which has become one of the issues for the clean energy transition. The presentation is then continued by an explanation regarding the existing China’s collaboration in clean energy projects, which reflects how China allocate their investment in renewable energy (RE) Projects. Mr. Sandy Maulana continues the presentation by discussing the major challenges, including institutional and regulatory issues, limited fiscal space, and project readiness. The elaboration on the way forward, namely policy recommendation, ASEAN clean energy technology finance roadmap, and a proposal for clean energy technology finance roadmap, concluded the presentation.

This session highlighted the potential of RE as a critical component in achieving ASEAN’s target of reducing dependency on fossil fuels. The report also identified significant challenges AMS faces in attracting private finance and provided strategies to improve the enabling conditions for private investment in RE.

This session highlighted the potential of RE as a critical component in achieving ASEAN’s target of reducing dependency on fossil fuels. The report also identified significant challenges AMS faces in attracting private finance and provided strategies to improve the enabling conditions for private investment in RE.

The session is then followed by a discussion session which Dr. Ambiyah Abdullah led as the moderator. In this session, Dr. Ambiyah Abdullah, Mr. Imaduddin Abdullah, Mr. Sandy Maulana, Mr. Asdirhyme bin Abdul Rasib and Ms. Wang Xuelian discussed and answered questions from the participants. Most of the questions being discussed are about the viability of the financing scheme in terms of the energy penetration in ASEAN, green taxonomy, and the potential public resistance regarding fossil fuels subsidy removal and carbon tax introduction. Mr. Imaduddin Abdullah also highlighted the limitation of the reports due to different issues faced in AMS countries.

The event concluded with closing remarks from Dr. Zulfikar Yurnaidi, Manager of ACE, who emphasised the importance of leveraging private finance to accelerate the transition to clean energy and achieving ASEAN’s RE targets. He also encouraged collaboration between countries and stakeholders to create an enabling environment for private investment in RE.

Overall, the event provided a platform for key stakeholders to come together and discuss potential strategies and financing opportunities for the transition to ASEAN’s decarbonisation pathways. The report’s findings will serve as a valuable resource for policymakers, investors, and industry players in the region as they work towards achieving the clean energy targets set by ASEAN.

(JK, AB)