Menu

As ASEAN embark on the journey towards higher deployment of green energy technologies, there is no denying that critical minerals will play a pivotal role. Globally, the energy transition is projected to produce 6.5 billion tonnes of end-use materials between 2022 and 2050, which 95% would be the required supply of steel, copper, and aluminium. The demand for critical minerals in ASEAN is set to follow an upward trajectory, parallel to the 7th Edition of ASEAN Energy Outlook (AEO7) projection of renewable energy added capacity reaching 41.5% in and estimated up to 2.5% of the Electric Vehicle (EV) fleet by 2025.

These chemical elements are set to become as indispensable to the world of renewable energy as oil and gas have been to the fossil fuel era. The landscape of global geopolitics is evolving, and it’s not just limited to oil; critical minerals are expected can pose geopolitical challenges due to the tension between the geographic concentration of critical resources and the increasing global competition for supply. Thus, it is becoming a most-sought “gold” in the geopolitical arena.

Shifting Trends to Critical Minerals: Geopolitical forces beyond control

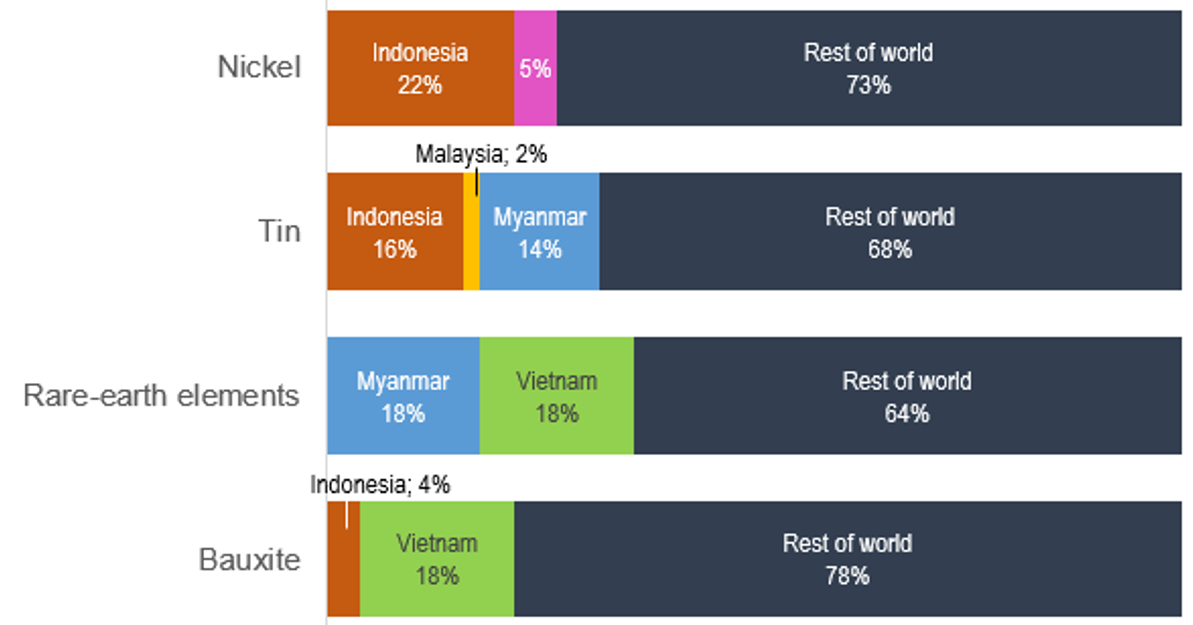

The minerals essential to the energy transition carry their own geopolitical risks, expected to be more complicated and volatile than the oil market, as they are largely centred in a few distinct regions across the globe. Selected ASEAN countries have a crucial role of critical minerals, particularly nickel for Indonesia and the Philippines, and certain RREs, including Viet Nam, Malaysia, and Myanmar. This gives the potential for disputes with strong competition and influence amongst major geopolitical and economic powers. Figure 1 shows that four key minerals reserves, nickel, tin, rare-earth elements (REE), and bauxite are largely centered in ASEAN.

Figure 1. ASEAN Critical Minerals Reserves (2022)

As an emerging bloc, ASEAN is an emerging bloc, ASEAN is a significant energy supplier and a staunch supporter of the shift away from fossil fuels. ASEAN is transforming into a facilitator of this transition and investing in greener technologies for a more sustainable global environment. Most of member states, such as Indonesia, Vietnam, and the Philippines are racing to go beyond mineral extraction for facilitating global demand of clean technologies.

Developing global markets in critical minerals brings promising benefits to the ASEAN region. For example, the Philippines is among the five most mineral-rich nations in the world, with untapped reserves valued at USD 1 trillion, roughly three times the nation’s GDP in 2021. Indonesia’s abundance of nickel has led to a surge in foreign direct investment and rapidly increased exports, estimated at USD 8.39 billion in 2020.

However, there are some examples of how geopolitics complicates ASEAN countries in facilitating the global energy transition measures. Indonesia, which controls the extraction of the greatest minerals reserves on Earth, labelling it as the Saudi Arabia of nickel, faced great geopolitical supply risks. In 2014, Indonesia prohibited raw nickel exports in a bid to draw investors for the manufacturing of EV batteries, which sparked a dispute with the European Union (EU) in the World Trade Organization (WTO) panel. Meanwhile, China, the largest producer of Rare Earth Elements (REE) relies on import from Myanmar and worries about its supply disruptions currently faced with the domestic conflict.

Meanwhile, countries that heavily invest in renewable energy, like Europe and the US, are investing in securing access to critical minerals in Africa and South America, sometimes with concerns about exploitative practices. On the other hand, China continues to dominate the processing aspect. Just as we have seen energy play a central role in conflicts in the Middle East, a shortage of critical minerals or a possible market dominance conflict could translate into vertical political power for energy suppliers. Therefore, countries seek to diversify mineral supplies where resource-rich countries bank beneficiated mineral ore exports.

ASEAN has limited progress in processing capacity for diversified critical minerals, while the geological presence of resources alone is not sufficient to control the global market domination. However, there is hope in international cooperation, especially within the ASEAN region, which could help us seize the opportunities that lie ahead.

ASEAN Gaining Momentum to Market Dominance of Global Critical Minerals

Figure 2. ASEAN Raw Mineral Production

The opportunity for critical market potential in ASEAN was explicitly seen, particularly in Indonesia which is robustly secure cooperation under the Priority Economic Development under Indonesia’s ASEAN presidency. In addition, the notion was also shown during the ASEAN Energy Business Forum (AEBF) 2023 side event of “Critical Minerals: Opportunities and Challenges for ASEAN” that Indonesia has 47 points of minerals with longer lifespan than other countries. In 2020, the majority of global production of nickel and tin came from ASEAN. Our global production is estimated at 47% and 35%, with net exports of nickel and tin, US$ 551,8 million and 1,5 billion respectively. Indonesia and the Philippines are leading the charge in nickel extraction, accounting for almost 60% of global nickel extraction. However, these countries can act as facilitators in this domain largely depending on our domestic actions.

Member states have issued policies to secure, diversify, and add value of its supply chains. In 2021, the Philippines annulled restrictive mining policies, such as prohibiting open-pit mining and attracting mineral investment under the DENR Administrative Order 2021-40. In 2021, Malaysia developed a policy framework, the National Mineral Industry Transformation Plan 2021-2030, to develop and streamline the sustainable management of the mineral industry. Meanwhile, Indonesia focused on EV battery production to gain the economic value of its critical minerals, which is viewed as a gateway of Southeast Asian countries following a significant amount of foreign direct investment in the region in 2019-2021.

Ensuring the stability of the critical mineral industry in the region holds paramount significance, covering activities such as extraction, processing, and research and development. The matter is that many developing countries lack the ability to transform raw resources into processed materials, which will maintain their role to serve as commodity suppliers rather than offering socio-economic benefits. Additionally, initiatives to scale manufacturing capabilities, including skill training and career development, are required to prevent environmental deterioration and adverse effects on labour and local communities from the competition for resources.

By investing in these domains, the region can gain a strategic advantage and pave the way for a sustainable and prosperous future. Indonesia, being the foremost minerals producer in the region, should encourage coordinating efforts and harnessing the indigenous knowledge of ASEAN Member States (AMS) to explore, extract, manufacture, and innovate to safeguard the region’s mineral resources. Pouring investment in many key minerals and metals allows ASEAN to be the epicentre of the supply chain and effective reserve management will be a critical tool. Moreover, energy diplomacy needs to be considered as the centre of foreign policy priority to ensure the regional capability in securing the supply chain of minerals. Energy transition should be placed as a re-start button towards just and equitable energy sector.