Menu

Hydrogen is often seen as the fuel of the future due to its unique properties. First, it is a clean fuel, as the only byproduct of hydrogen when used to generate electricity is water. Second, hydrogen has thrice the energy density (120 MJ/kg) of gasoline and diesel, making it a promising option for energy storage applications. Finally, hydrogen’s dual role in energy storage and generation, as they are reverse reactions of each other, adds to its versatility. In terms of cost, technologies like fuel cells and electrolysers are becoming more affordable. Fuel cell prices have dropped 60% from 2006 prices with further reduction of 65-85% anticipated by 2050, and the cost of electrolysers is expected to decrease by 15%-30% by 2030 due to the availability of excess electricity from renewables. Thus, hydrogen’s duality as both a fuel and an energy carrier positions it as a vital link between electricity from renewables and broader applications, including substitutes for aviation fuel, residential heating, and decarbonising industries such as steelmaking, which is renowned for being ‘hard-to-abate’.

According to a recent report by the ASEAN Centre for Energy (ACE), low-carbon hydrogen has the potential to significantly transform ASEAN’s energy landscape. Although current hydrogen is produced primarily from methane or coal combustion, known as grey hydrogen, transitioning to cleaner hydrogen will be critical in fulfilling the region’s projected increasing energy demand, projected to increase by approximately 215% from 2030 to 2050. Tapping into indigenous resources to produce blue and green hydrogen can enhance energy security for ASEAN Member States (AMS) while supporting the gradual shift away from fossil fuels. Currently, nearly 40% of the region’s oil supply is imported, and hydrogen offers a path towards reducing this dependency.

As countries globally strive towards carbon neutrality, many AMS have recognised hydrogen’s instrumental role in decarbonisation. Countries like Indonesia, Malaysia, Singapore and Vietnam have released national hydrogen strategies aimed at identifying early opportunities for low-carbon hydrogen use. Current progress had gone beyond the planning stage, as in 2022 alone, at least 14 hydrogen-related project finance deals were announced in ASEAN.

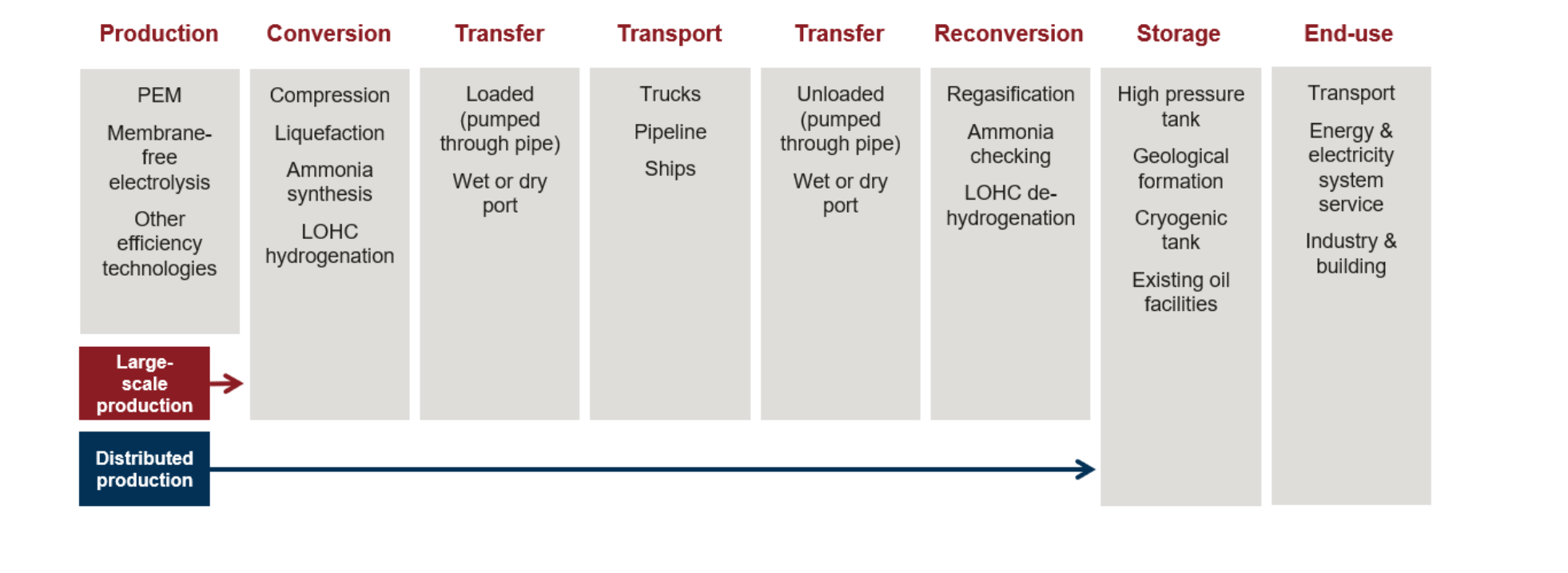

However, like any emerging technology, hydrogen faces challenges related to its current economic viability. It is not yet as competitive as fossil fuels, as the development of low-carbon hydrogen will require substantial infrastructure investment across the entire value chain. Numerous new facilities will be required in almost every step of the value chain, as evident in Figure 1 below. Hydrogen production will not only require production facilities—such as on-site renewable energy power plants and electrolysers, for the case of green hydrogen—but also facilities for transporting, storing, and end-use conversions of the produced hydrogen.

Figure 1. Hydrogen value chain (AIIB, 2023)

To understand the cost of producing low-carbon hydrogen with existing resources, a recent report by ACE evaluated the cost if each AMS exported low-carbon hydrogen to East Asian markets using current prices. The result indicates a cost range between USD 9-11/kg for green hydrogen and USD 5-7/kg for blue hydrogen. While these figures may appear reasonable, it is important to note that for hydrogen to compete with fossil fuels, it must be priced as low as USD 4/kg for applications in the transport sector, or even USD 1-2/kg for applications in the power and industry sectors.

What are the biggest contributors to these costs? Although the answer can vary based on specific parameters set during calculations, ACE’s research highlights that 85-94% of the export cost is attributed to the production stage when evaluating green, blue and grey hydrogen production pathways. A closer examination of the levelised cost of hydrogen—which represents the cost to produce 1 kg of green hydrogen—reveals two major cost drivers of the LCOH are renewable energy electricity, which accounts for 40-70% of LCOH, and electrolysers, which represent 33-45% of total capital costs. Therefore, focusing on technological innovation and achieving economies of scale, in these two areas is essential for reducing costs.

From a financial perspective, the core issue is the risk. Cost is not so much of an issue as working capital can be raised through debt financing. In fact, the typical capital structure of renewable energy project finance is majority debt: a typical solar photovoltaic (PV) project has a 9:1 debt-to-equity (D/E) ratio. However, the D/E ratio of different projects may differ, reflecting on the risk levels associated with each project.

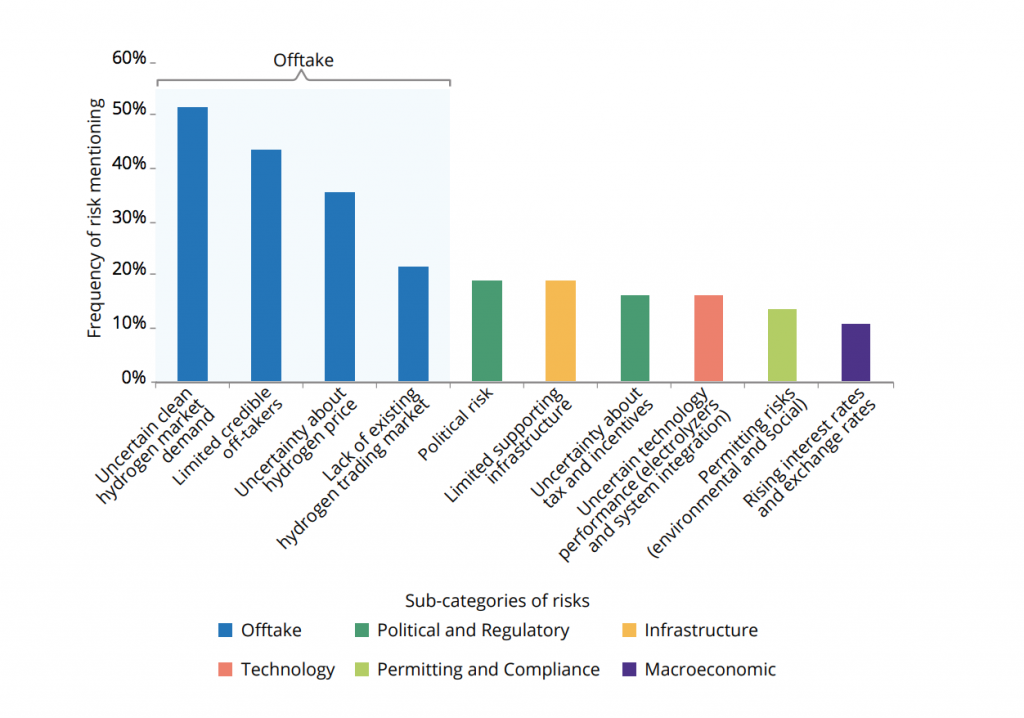

Figure 2. Top risks associated with low-carbon hydrogen, which if mitigated, would enable hydrogen projects to secure financing (ESMAP, 2024).

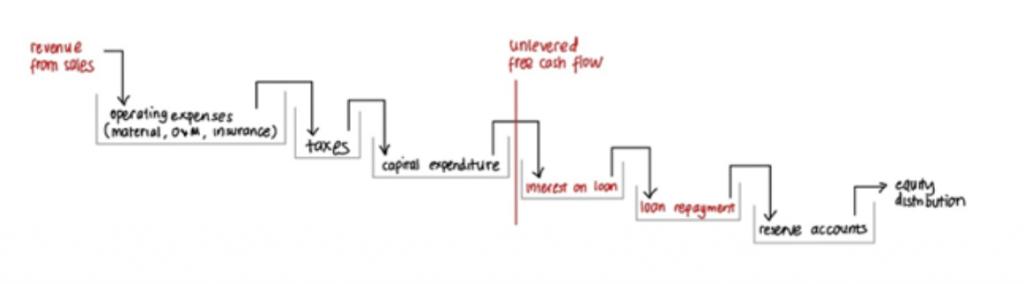

While there are various types of risk as illustrated in Figure 2, commercial lenders, particularly banks, are most concerned with default risk— the risk that borrowers may not meet their debt obligations on time. The likelihood of default risk depends largely on the availability of free cash flow—as illustrated in Figure 3, which refers to the cash a project has after accounting for operating costs and capital expenditures. This cash flow is used to repay loans and distribute dividends.

For lenders, the ability to forecast future revenues with confidence is essential, and this is where a key challenge arises: estimates indicate that low-carbon hydrogen demand is currently very limited. Most existing demand is concentrated in traditional sectors, where it is met by cheaper fossil-fuel-based hydrogen. This is the exact reason why banks tend to impose more conservative financial covenants—such as maintaining a certain D/E ratio—for projects with a higher perceived risk, like low-carbon hydrogen, which typically has a 6:4 D/E ratio.

Figure 3. Simplification of a typical cash flow waterfall.

(Adapted from the United States Department of Transportation)

This cycle of interdependency between supply and demand has long hindered the development of low-carbon hydrogen. Supply requires demand to achieve economies of scale and reduce costs, yet demand requires a reliable supply for lenders to confidently support projects

Is this cycle truly inescapable? AMS must break away from this loop to advance their decarbonisation goals. Low-carbon hydrogen can facilitate seamless sectoral integration between end-use sectors and help manage excess renewable electricity during peak production hours, fostering a positive cycle in the energy transition. A closer examination of investment risks, coupled with tailored derisking measures, will be essential to overcoming the current hesitancy in financing low-carbon hydrogen projects.