Menu

ASEAN Energy Development: Pre COVID-19 Status and Progress

2020 is incredibly tough for ASEAN energy development as Covid-19 brings unprecedented challenges to the sector. With the five years left to run towards its regional target of 23 per cent share of renewable energy in total primary energy supply, in the pre-COVID-19 era, ASEAN already needs to accelerate the effort as the share is still around 14.3 per cent in 2017. To accelerate this progress, ASEAN really needs to seek a new strategy to cope with uncertainties which the pandemic has brought in the horizon. Electricity, as the main sector that contributes to accomplishing the target, needs to recover quickly to catch up with the target. ASEAN needs to install approximately 166 GW of renewable electricity by 2025 if ASEAN does not want to miss the target (ACE, 2017). In 2018, there is 67.3 GW of renewable electricity installed across the whole region with hydro, bioenergy, solar and wind being as the most installed respectively (AEDS, 2020). However, the oversupply of electricity as well as the war price on the crude oil, bring some importer oil countries a bit of relief. For countries who rely on the export of fossil fuel commodities such as coal, oil and gas will face different path if the impact of Covid-19 is continuing up to next year.

Covid-19 current impact on the electricity sector

Due to a mobility restriction, the fast-spreading Covid-19 causes severe to all the sectors including the energy sector. It also magnificently impacts on the supply and demand balance of fuels, as well as a retardation of tonnes energy projects (from oil and gas to transmission and biofuel promotions). In demand side, ASEAN experiences decline in all sector with various degree of severity. This part will depict the impacts of Covid-19 in electricity demand by snapshotting one or two grid system in the ASEAN Member States.

Reduction of electricity demand in industry and commercial

As most of its members are developing countries, ASEAN is a good fit for industry and commercial to grow. The electricity demand of industry and commercial has been increasing year by year, as it is reflected in the region’s electricity consumption from 2005-17 (AEDS, 2020). Fig. 1 shows a CAGR of 5.9 per cent and 5.5 per cent for industry and commercial. Among others, electricity consumption in the industry represented 43 per cent of total electricity consumption in ASEAN in 2017. Therefore, when corona hit ASEAN, the effort to curb in the form of quarantine and mobility restrictions which cause the operational shutdown of several power plants may significantly impact the electricity consumption in 2020.

During Covid-19 outspread, some ASEAN Member States forced operational stop for some non-fundamental goods industries to avoid the increase of human-to-human virus transmission. In red-zone cities, where the numbers are rapidly rising, many offices and buildings have also applied for work from home measure since May or April due to the quarantine actions taken by the government. Indeed, this may impact the demand profile and its amplitude. In this article, Bangkok – as one of the busiest areas in ASEAN and Java-Bali system known as one of the biggest grid systems in ASEAN was considered as an example for the analysis of the Covid-19 impact to the overall ASEAN electricity sector.

In January to March 2020, Bangkok Metropolitan Area’s power max demand started increasing normally. Due to an emergency lockdown on 26 March, the demand has fallen from 8706 MW in March to 7998 MW in April 2020. Fig. 2 shows the Bangkok Metropolitan Area’s maximum power demand in 2020 is much lower than in 2019, wherein 2019 the peak demand of this area could reach 9,526 MW

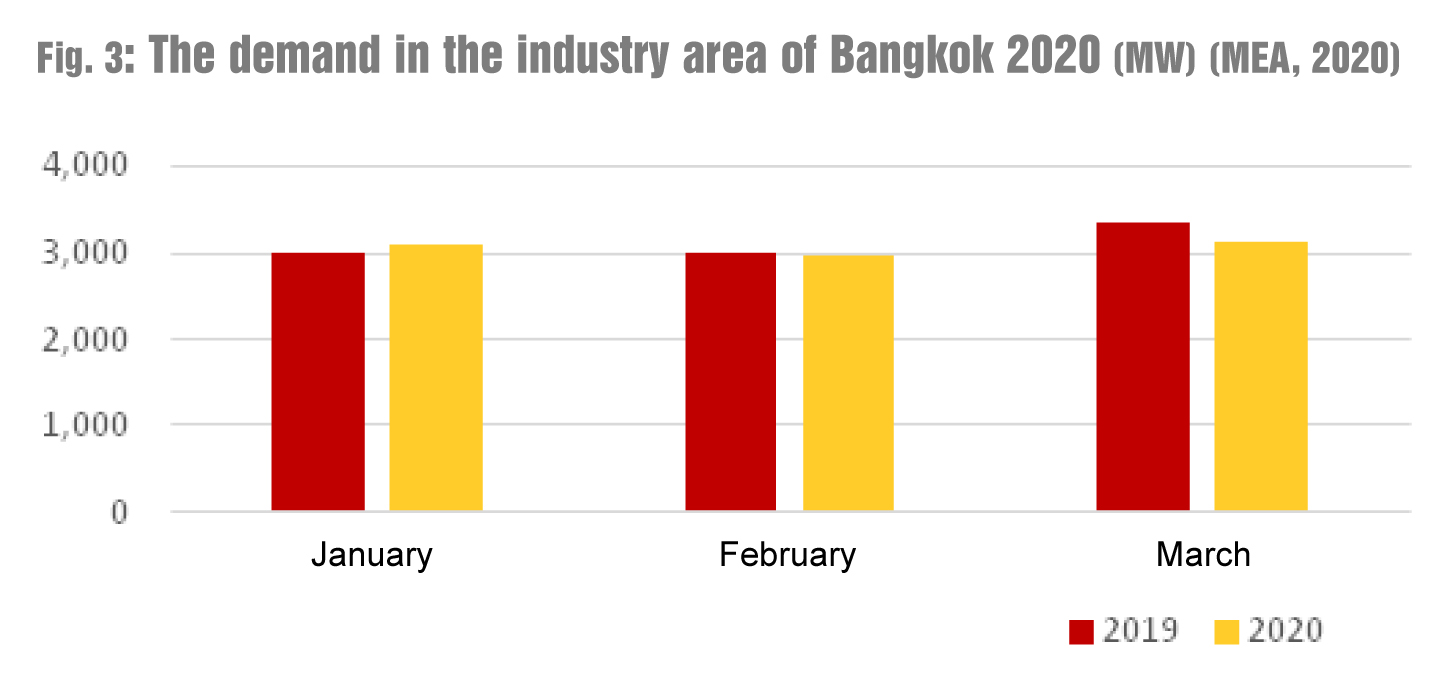

According to publicly available data for electricity demand by sector from January to March 2020 (as of May 25, 2020), the data shows that there is a normal increased of residential electricity demand, however, there is a 9 MW drop on industry electricity demand, starting by February 2020 (see Fig. 3). Industrial electricity demand shows a bigger gap of 223 MW in March 2020 – and it may also be reduced more in April 2020 following the lowest point of max power demand in April 2020.

Like the hearth of a business centre, Jakarta and Banten area are the most commercial area instead of a residential base. Inevitably, the restriction of workers mobility due to Covid-19 will impact the economic activities in this capital city. However, Indonesia does not apply the sudden restriction of everyone mobility since the first case found on March 2, 2020. Three steps are concluded from government regulation. First, the normal day – where it applies until the working from home regulations are mandated for several offices and commercial buildings on March 23, 2020. Second, the work from home period, where the initiatives are coming to comply with the existing regulation, yet, there was no mandatory regulation such as lockdown. Third, starting by April 10, 2020, the Large-Scale Social Distancing (PSBB) was implemented for Greater Jakarta followed by surrounding cities several days later.

To well depict the impact of Covid-19, the comparison of load in Jakarta-Banten during these three periods (March-April 2020) with last year data are proposed in this article. From PLN database (private access only), the range of demand can be 0-3 GW higher than last year data in the same date (positive change) or 1-3 GW lower than last year data in the same date (negative change). From 61 days (March 1-April 30, 2020), total days with negative change were identified starting from the working home initiatives. More negative changes are also shown during the PSBB period (April 10-31, 2020), where 15 days (out of 21) have negative change from last year demand (see Fig. 4).

The original op-ed can be found here.