Menu

The Methane Abatement Towards Sustainable Petroleum Industry (MAESTRO) program is an ASEAN Centre for Energy initiative to support regional methane emission reductions. With technical assistance from the World Bank Group’s Global Flaring and Methane Reduction Partnership (GFMR), the ASEAN Oil and Gas Methane Emissions Dashboard was developed as part of MAESTRO. Helping users identify emission sources across the region’s oil and gas sector, MAESTRO enables more effective monitoring and abatement strategies.

Methane is a potent greenhouse gas, with a global warming potential (GWP) 84 times higher than carbon dioxide (CO2) over a 20-year period. It accounts for nearly a fifth of global warming levels relative to pre-industrial levels. Rapidly reducing methane emissions is a crucial climate action that will rapidly deliver significant and much-needed short-term results.

Reducing methane emissions from oil and gas production is low-hanging fruit in tackling climate change and vital in aligning the global energy sector with the 1.5-degree global warming scenario. Approximately a fifth of anthropogenic methane emissions originate from the oil and gas industry, with half of these emissions coming from developing countries. Leveraging the full potential of methane reduction solutions in this sector could prevent roughly 0.1 degree Celsius of warming by mid-century.

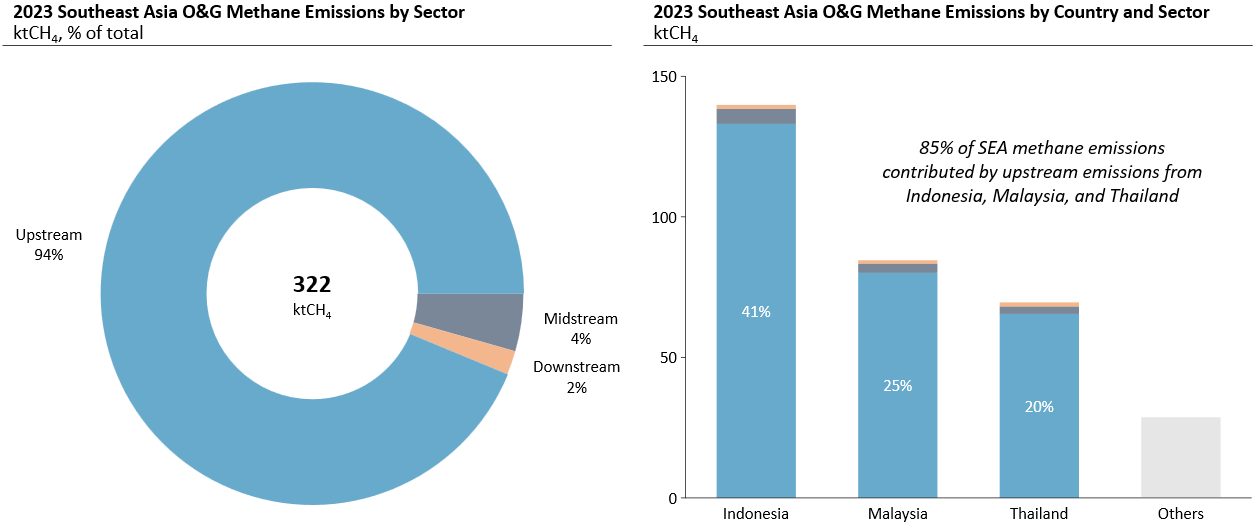

In 2023, ASEAN region emitted 0.32 million tonnes of methane, with a global warming potential equivalent to about 9 million tonnes of CO2. This accounts for the loss of approximately 0.5 billion cubic meters of gas, or about 7% of Singapore’s liquified natural gas imports in 2023. Key oil and gas producers in the region – Indonesia, Malaysia, and Thailand – account for nearly nine-tenths of the region’s methane emissions, largely from offshore activities.

About half of these emissions originate from Indonesia, with nearly half stemming from Sumatra alone, primarily from onshore production. Upstream assets in three key offshore production areas — Peninsular Malaysia, Sarawak, and Sabah — account for more than 90% of Malaysia’s emissions. In Thailand, offshore emissions in the Gulf of Thailand make up 60% of the country’s total emissions. Flaring operations account for 25% of emissions in the region.

Despite initiatives like Zero Routine Flaring by 2030 (ZRF) being endorsed by national oil companies such as Malaysia’s Petronas and Indonesia’s Pertamina, further action is needed, particularly to address fugitive and venting emissions. Implementing effective monitoring and abatement efforts in the ASEAN region could generate an additional $87 million USD in revenue.

Several Southeast Asian countries and companies have endorsed methane reduction initiatives, including the Oil & Gas Decarbonization Charter, the Global Methane Pledge, and the Oil & Gas Methane Partnership 2.0. At COP28, the World Bank announced the GFMR Partnership to help support developing countries with the least capacity and resources to curb these emissions through technical assistance and catalytic grant funding for methane and flaring reduction projects.

Definitions:

Methodology:

Contact us

For inquiries regarding our dashboard and MAESTRO project, or to discuss collaboration opportunities, please do not hesitate to contact us at [email protected]