Menu

ASEAN region is not only experiencing the fastest economic growth but also exhibiting an unprecedented surge in demand for cooling, driven by economic development and rising temperatures. The 8th ASEAN Energy Outlook (AEO8) projected that energy consumption from air conditioning will surge to 35.5 million tonnes of oil equivalent (MTOE) by 2050, covering about a quarter of energy demand in the building sector, encompassing both commercial and residential building. This presents three key challenges for the region‘s sustainable economic development, energy security, and climate action.

Today, the ASEAN Regional Policy Roadmap for Energy Efficient Room Air Conditioners (2022-2025) indicates that Air conditioner ownership in the ASEAN region is projected to increase significantly, with estimates suggesting that the number of units will grow from nearly 50 million in 2020 to approximately 300 million by 2040. This underscores the significance of addressing cooling efficiency standards in the ASEAN energy efficiency strategy.

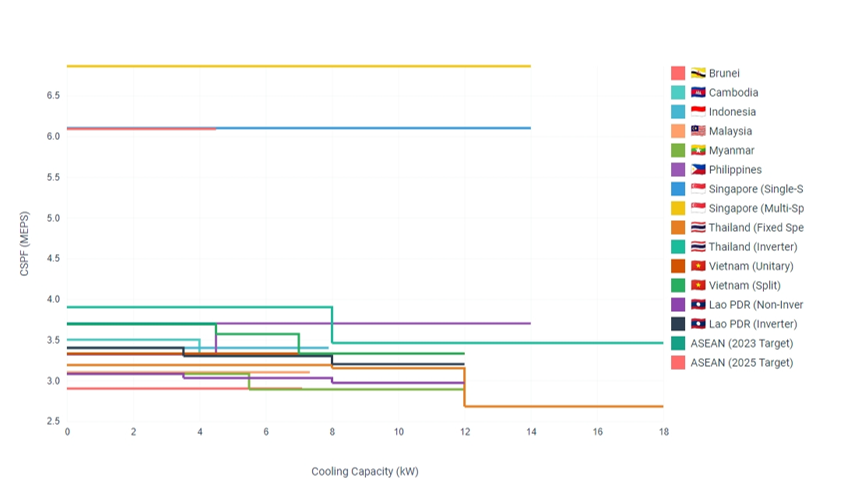

The ASEAN Centre for Energy (ACE) and Energy Efficiency and Conservation Sub Sector Newtok (EE&C-SSN) have taken a quantum-leap approach with coordinated Minimum Energy Performance Standards (MEPS) for Room Air Conditioners (RACs). Current regional MEPS, introduced in 2020, provide an energy efficiency performance standard of 3.08 ISO CSPF for models under a 3.52 kW cooling capacity. However, ASEAN has increased the ambitious standard to reach further harmonised MEPS at CSPF 3.7 in 2023 and 6.09 by 2030. By 2040, adopting these standards could save 144 TWh of electricity (equivalent to 66 power stations of 500 MW capacity) and reduce CO2 emissions by 101 million tonnes.

Singapore has shown significant progress by introducing more stringent standards, particularly on inverter air conditioners. Singapore has systematically strengthened its air conditioner MEPS since their introduction in 2011, initially setting a 2-tick minimum requirement that was later raised to 3-tick. In recent years, Singapore has implemented even more ambitious standards, removing less efficient 2-tick models from the market and advancing to 4-tick requirements for single-split units and 5-tick for multi-split systems (effective April 2025). The current MEPS establishes minimum Coefficient of Performance (COP) values of 4.86 for single-split systems and 5.50 for multi-split systems, equivalent to CSPF values of 6.10 and 6.86 respectively. This progressive tightening of standards has contributed to a remarkable 47% improvement in air conditioner efficiency across Singapore, positioning the nation as the regional benchmark for cooling efficiency in the ASEAN region.

Indonesia, Malaysia, Thailand, the Philippines and Vietnam have also demonstrated significant advancement in implementing MEPS regulations, though they have yet to achieve the harmonised standard across the ASEAN region. These nations exhibit varying degrees of MEPS, with each country prioritising different efficiency metrics appropriate to their respective markets and climate conditions. The disparity in standardisation underscores both the progress made individually and the opportunity for greater regional alignment, particularly when compared to Singapore’s exemplary benchmarks that currently lead the ASEAN community in energy efficiency requirements.

Cambodia, Lao PDR, and Myanmar have some enabling environments in the absence of mandatory measures for MEPS, including an online Product Registration System, a national roadmap for efficient ACs, and EE S&L Ministerial Regulation (Prakas).

Figure 1. MEPS Stringency in ASEAN (ACE Database, 2024)

Manufacturers across the ASEAN region face significant challenges in implementing new, more stringent MEPS requirements. As demonstrated in the case of Malaysia, during stakeholder consultations, local manufacturers expressed serious concerns about market readiness and timing for implementing the ambitious regional CSPF 6.09 target by 2025. Their feedback revealed that local manufacturing capacity would require substantial adaptation time, with the industry proposing a more gradual implementation approach with interim MEPS levels. Malaysia’s phased implementation plan, with targets for 2026-2029 and 2030-2035, reflects this need to balance regional harmonisation goals with protection of domestic manufacturing capabilities.

These challenges are echoed across the region, with Indonesia specifically highlighting “industry’s lack of technological and financial capacities” and “fear of slowing business due to increasing selling price” as key barriers to MEPS implementation. The varying MEPS levels across ASEAN countries – from Singapore’s advanced standards (COPweighted ≥ 5.50 for multi-split systems) to more modest requirements in emerging economies – demonstrate how implementation must be tailored to each country’s manufacturing capabilities and market conditions.

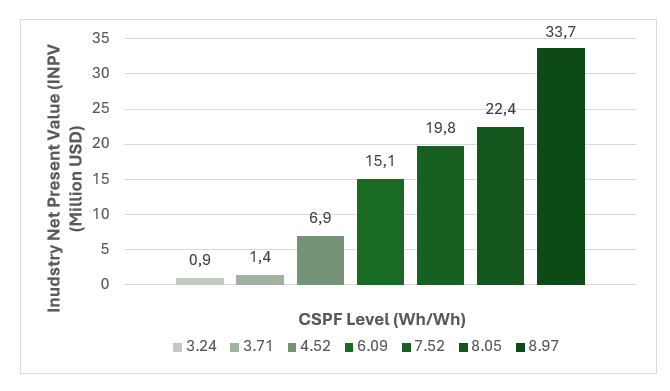

Encouragingly, a study conducted by the Lawrence Berkeley National Laboratory entitled ‘Accelerating the Transition to More Energy Efficient Air Conditioners in Indonesia’ (2020), as synthesized in ACE’s review “Assessing the Impact of ASEAN’s Harmonised Minimum Efficiency Performance Standards on AC Manufacturers” provides evidence that these challenges can be overcome with positive outcomes. The Lawrence Berkeley study, which assumes that demand for air conditioning in tropical regions like ASEAN is relatively non-elastic (meaning demand remains stable despite price changes), reveals that increasing adaptability to higher efficiency standards will push manufacturers towards inverter RAC for considerable growth. The new higher MEPS are expected to have a positive Net Present Value (NPV) impact for manufacturers, despite initial anticipated implementation costs. According to the detailed manufacturer impact analysis in the study, NPVs are expected to rise by 15-20% over five years for small manufacturers, and 25-30% for larger manufacturers, mainly due to economies of scale and growing share in the premium segment. For example, Indonesia expects inverter RAC penetration rates to more than double from 2021 to 2026, while mature markets such as Singapore are already saturated. However, it’s crucial to strike a balance between manufacturer benefits and consumer affordability, as air conditioning represents a basic need in the hot tropical climate of the region. While higher efficiency standards eventually lead to lower lifetime operating costs, the initial higher purchase prices could potentially burden consumers if implemented too rapidly. Along with these economic advantages, the brand image improvement and higher competitiveness in the booming market of efficient appliances further support the case for manufacturers to embrace these changes, provided that implementation timelines are carefully calibrated to maintain accessibility for consumers across income levels.

Figure 2. Economic Benefits of Higher Efficient Air Conditioning (ACE, 2024)

ACE has put several key initiatives in place to help facilitate this transition. A prototype of product registration database at the regional level gives better visibility of approved products across countries, and Green Public Procurement Guidelines serves as a means to facilitate the uptake of new energy-efficient cooling technologies. Providing technical assistance, capacity building, and market assessment support to member states through our partnerships with international organisations such as the United Nations Environment Programme’s – United for Efficiency (UNEP-U4E) through ASEAN Cool Initiative.

Moreover, the establishment of the ASEAN EE&C Working Group for Appliances in 2024 marks an effort to progress the implementation of MEPS. This task force brings together ASEAN policymakers and experts from each member state to accelerate the achievement of outstanding milestones under the ASEAN Plan of Action for Energy Cooperation (APAEC) 2016-2025 Phase II:2021-2025 EE&C Programme Area, as it approaches its completion year. Additionally, as ASEAN develops the new APAEC Post-2025, targeted for endorsement during Malaysia’s ASEAN chairmanship, the more ambitious MEPS level should be institutionalised in the new APAEC that strengthens the implementation of the harmonised Air Conditioner MEPS and its Monitoring, Verification, and Enforcement (MVE) systems, thereby significantly increasing the adoption of energy-efficient air conditioners in the ASEAN market.