Menu

Methane’s high climate impact—84 times the warming potential of CO₂ over 20 years—emphasises the urgency of reducing it from the oil and gas sector, which responsible for about 20% of global methane emissions. This sector offers ASEAN a critical opportunity for rapid emissions cuts, advancing the 1.5°C climate goal. In 2023, ASEAN’s oil and gas operations emitted 0.32 MtCH4 (9 MtCO₂ equivalent), a climate impact that could be avoided. This also represents a preventable loss of 0.5 billion cubic metres of natural gas, covering about 7% of Singapore’s annual LNG imports.

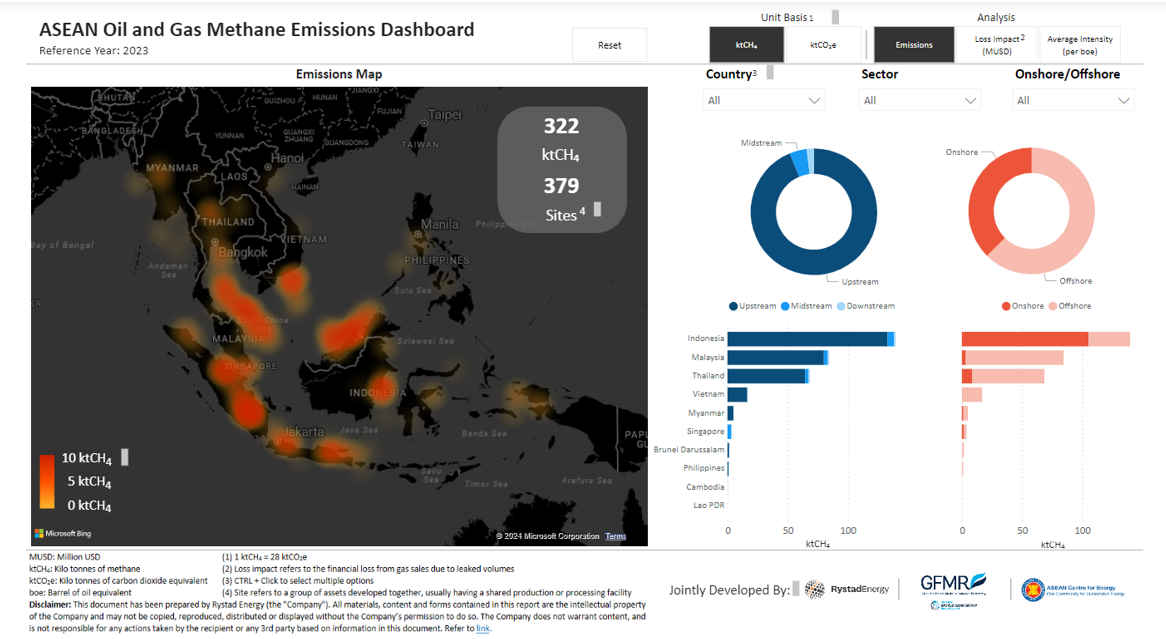

As ASEAN Member States (AMS) continue to rely on oil and gas for growth and energy security, methane emissions are a pressing concern. According to the 8th ASEAN Energy Outlook (AEO8), oil use grew by 10.6% in 2022, while natural gas rose by 5.6%. The AMS Targets Scenario (ATS) projects a 39.5% decrease in oil supply by 2050, with natural gas playing a transitional role as coal use declines under the Carbon Neutrality Scenario (CNS). Indonesia, Malaysia, and Thailand show strong potential for methane abatement, supported by the ASEAN Oil and Gas Methane Emissions Dashboard. This tool enables stakeholders to track emissions and progress, helping drive effective, data-informed strategies for climate resilience.

What ASEAN Oil and Gas Methane Emissions Dashboard shows us?

The ASEAN Oil and Gas Methane Emissions Dashboard, developed by the ASEAN Centre for Energy (ACE) and The World Bank’s Global Flaring and Methane Reduction Partnership (GFMR) Partnership, shows that 93.7% of methane emissions in ASEAN’s oil and gas sector stem from upstream activities. Offshore sites contribute 62% of emissions, while onshore operations account for 38%. Methane losses across all recorded sites are valued at 87 million USD, with Indonesia’s upstream sector experiencing the highest impact at 37 million USD from 147 sites. Offshore facilities in Malaysia, Thailand, Viet Nam, Myanmar, and the Philippines contribute an additional 44 million USD in losses, and Singapore’s midstream/downstream operations incur 1 million USD.

For ASEAN Member States, many of which are developing countries, balancing methane abatement with energy and economic priorities is crucial. Rapid economic growth demands a surge in energy production, often accompanied by increased emissions. Integrating methane reduction into Environmental, Social, and Governance (ESG) frameworks allows the oil and gas sector to address climate impacts without compromising regional energy needs or development goals. Through such a balanced approach, ASEAN can contribute to global emission reduction targets while advancing its energy and economic aspirations.

Targeting Environmental Hotspots

Environmental hotspots in the dashboard, defined as areas where methane emissions from oil and gas sector are concentrated across the region, especially in Indonesia and Malaysia. These hotspots intensify the release of methane, leading to elevated levels of ground-level (tropospheric) ozone—a harmful pollutant that significantly degrades air quality and threatens human health. In Indonesia, Sumatra’s onshore sites are notable hotspots, while Malaysia’s offshore regions are similarly high-emission areas (see Figure 1., point number 1 and 3). Additional onshore hotspots are detected in Thailand and Myanmar (see Figure 1., point number 5 and 6).

Leveraging the dashboard can help stakeholders in high-emission areas improve operational standards. By identifying specific emission sources such as well pads, compressors, and processing plants, companies can align with appropriate abatement technologies and procedures, while enhancing the efficiency of monitoring and reporting system. Although the dashboard indicates financial losses of approximately $87 million due to methane leaks, the broader costs, including environmental and health impacts, are much higher.

Figure 1. ASEAN Oil and Gas Methane Emissions Dashboard, ACE, 2024

PETRONAS has advanced methane emissions reporting by deploying a digital platform to monitor emissions from 11 key sources, integrating this data into broader GHG metrics. On 4 November 2022, it joined UNEP’s OGMP2.0, enhancing measurement accuracy and transparency. In 2023, PETRONAS submitted its inaugural OGMP2.0 report with a five-year plan to attain the Gold Standard, achieving the Gold Standard Pathway for the 2022 reporting year by August 2023, reinforcing its climate commitment.

Draining Community’s Pocket

The environmental toll of methane emissions extends beyond ecological degradation, carrying substantial social costs as well. When emissions lead to environmental harm and health issues, the resulting damages are often regarded as external costs—borne by communities rather than the industries responsible. Economists refer to this as a negative externality, where the social costs fall heavily on those not directly involved in the operations. Such impacts can be significant, the US Environmental Protection Agency estimates methane’s social cost to range from $1,300 to $2,300 per tonne, while recent study suggest a figure as high as $4,000 per tonne due to enhanced damage calculations. For ASEAN, these costs are particularly concerning, as methane emissions contribute to air pollution and health issues in densely populated areas, especially the ones near the hotspots. Nevertheless, further research is needed to determine the precise range of methane’s social cost in the region.

Beyond financial implications, methane-driven environmental harm often triggers social conflicts, including sit-ins, protests, transport blockades, and other public demonstrations, which, from an economic perspective, translate into additional social costs. These conflicts picture the urgency of addressing emissions holistically. This data-driven approach not only supports regulatory efforts by providing accurate, real-time emissions data, but also offers businesses a clear framework for identifying and implementing measures to reduce emissions, minimising negative impacts on surrounding communities. Furthermore, the dashboard’s progressive improvement in data collection efficiency ensures a more streamlined and cost-effective process over time.

Is All About Working Together

The dashboard offers an unprecedented view of methane emissions across the oil and gas sector in the region. As the first comprehensive geographical compilation of such data, it provides critical insights that can guide stakeholders towards targeted actions. However, the dashboard’s value ultimately depends on strong regulatory frameworks and compliance mechanisms. Effective policy must combine both prescriptive regulations (requiring specific technologies or processes) and performance-based standards (outlining emissions goals while allowing operators flexibility in achieving them).

Yet, a policy’s success hinges not just on its design but on effective implementation and strict enforcement. Notably, policies targeting fossil methane tend to be less stringent than those for methane from other sources, likely due to industry resistance, economic dependence on fossil fuels, and energy security concerns. The recent amendment to the EU Methane Regulation exemplifies the importance of stringent enforcement. Since July 2024, it has led some European operators to reconsider U.S. LNG purchases due to compliance complexities. In ASEAN, for the dashboard to drive meaningful change, robust policy creation and unwavering commitment to compliance are essential to transform it from a mere tool into a force for emissions reduction.