Menu

Analysis on polling result of Launching Talk “Renewable Energy Outlook and the Challenge on Investment in ASEAN during Covid-19 Pandemic”

Before the pandemic hits, the global renewable energy development was somehow quite promising. It is no different with ASEAN, where the renewable progress starts to pick up. The region is racing toward its aspirational target of having 23% RE share by 2025 – which indeed still have a quite big gap from the current level of around 14.3% (2017). However, the COVID-19 pandemic brings this challenge to another level which adds up complexity in catching up with the region RE goal.

In our first edition of Renewables COVID-19 Energy Insight series, we indicated that the initial pushed back in the renewable business is due to supply chain disruptions and the halted RE projects. The mobility restrictions and lockdowns in China as well as in ASEAN as measure to curb the spread of the virus has impacted in significant lost and delayed in ASEAN RE projects as RE workforce and flow of goods were temporary stopped. After six months of experiencing the pandemic, we found out in our second edition of energy insight that RE recovery is still somehow slow as still many projects are postponed while ASEAN governments are grappling to come up with green recovery plan to overcome the impact of COVID-19 and achieve a resilient energy sector.

Understanding public’s point of view on the pandemic impacts to ASEAN RE progress could be valuable for policy maker to plan the recovery strategy ahead. ASEAN Centre for Energy did a virtual Launching Talk a while ago on August 6th 2020, titled “RE Outlook and the Challenge on Investment in ASEAN during COVID-19 pandemic” to officially launch RE Investment policy brief for 10 AMS. The talk was attended by 493 participants from 41 countries. During the webinar, short online survey was conducted to hear out opinion from the audience on the related topic of the discussion. This article is intended to convey the poll results and bring some insights of what the public think about COVID-19 pandemic impact to the ASEAN RE progress.

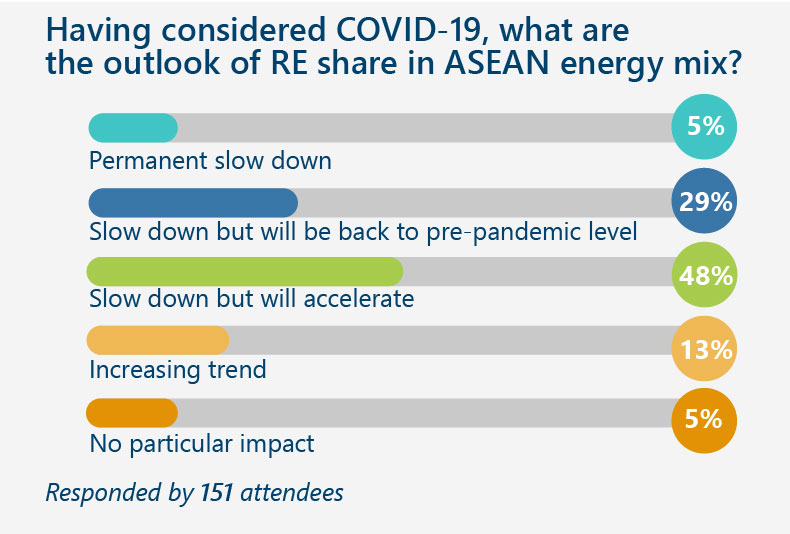

Result 1: Covid-19 Pandemic causes RE slow-down, but after pandemic acceleration is expected

The first question was asked is “Having considered COVID-19, what are the outlook of RE share in ASEAN energy mix?”. This question was answered by 30% of the total webinar attendees. Half of them agrees that this pandemic cause slow-down in RE progress, however they lean to the optimism that it will accelerate once the pandemic is over. About 29% also agrees the slow down in RE effort is inevitable but it will be back to pre-pandemic level. Nonetheless, it is interesting to see that around 13% still think the opposite that the pandemic induces a positive influence for RE sector, leading to an increasing trend of RE effort during the pandemic.

This optimism could be partly true as several countries in ASEAN region has an ample room to reconsider their economy & energy outlook and choose to design a greener recovery pathway for the future. If the region put focus on ‘build back better’ not only in their economy but also in the way energy is generated and used, it is not impossible that we could still meet the target in 2025. The new normal roll-out also shows that behavioural shift of how people commute, work, and consume their energy can create new opportunities for RE and EE innovation to plays a significant role in post pandemic era.

Result 2: Pandemic to ASEAN RE investment: either a threat or a driver?

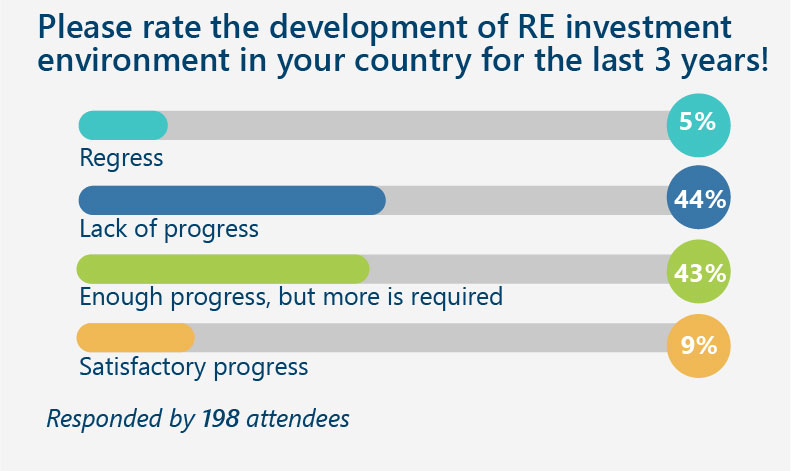

The second question was asked is “Please rate the development of RE environment in your country for the last three years”. This question has responded by 198 attendees or around 40.2% of the total people in the room. The result shows that there are two majority answers, a group that agree there is enough RE progress but more is required (44%) and a group that still see that there is still lack of progress in their country (43%). Only small portion that answer that the progress is satisfactory (9%) and regress (5%). This result provides us insight that there is room to attract more RE investment in ASEAN.

Comparing to other regions, ASEAN is not aggressive enough to catch the global investment opportunities. The region should be more ambitious in creating good investing climate for RE by enhance the easiness of investing framework as well as practice transparent and open manners to attract investors. The answer to this poll also could be translated that government should inform the progress of RE development more frequent and update for the public. It is possible that this answer reflect that the poll participants do not aware that the country’s RE is progressing while there has been actually good progress towards it.

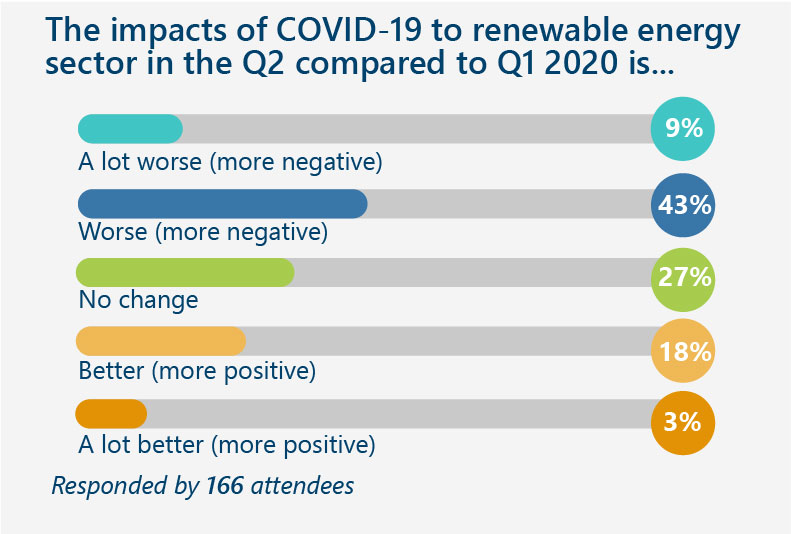

Result 3: COVID-19 hits ASEAN RE harder in the second quarter of 2020

The last question was asked during the webinar is “The impact of COVID-19 to RE sector in the Q2 compared to Q1 2020 is..”. This question is intended to know the audience think about the impact of COVID-19 to RE sector in the second quarter of 2020 compared to the early pandemic days. Around 166 attendees responded to this question and 43% says that the impact in the second quarter is somehow worse compared to the first quarter. About 18% think that the second quarter is better and 27% vote for no change. This result is interesting as hypothetically the second quarter would be better as lock-downs and mobility restrictions in many areas are lifted or eased hence the workforce and supply chain of RE good are restored. However, the findings show that public still sees RE sector are worsen and yet to recover. Follow up poll need to be done to find possible reason behind this perspective. One of possible reason to back up this opinion is because the uncertainty which brought by the pandemic leads to many project cancellation and divert the appetite for RE investment as the support from the government to this sector maybe reduced or shifted. The falling of coal, oil and gas price could also put pressure for RE, as several countries take the opportunities to stockpile the cheap fuel when it is possible.

Albeit the short and limitation of the poll questions performed, these findings are still beneficial to tell us the general perception from the public in relation to COVID-19 and RE sector. It may be worth to continue to dig deeper to understand the reasoning of each opinions hence it could be used as proper input for the government to design the recovery action and communication strategy for the progress of RE in the future.